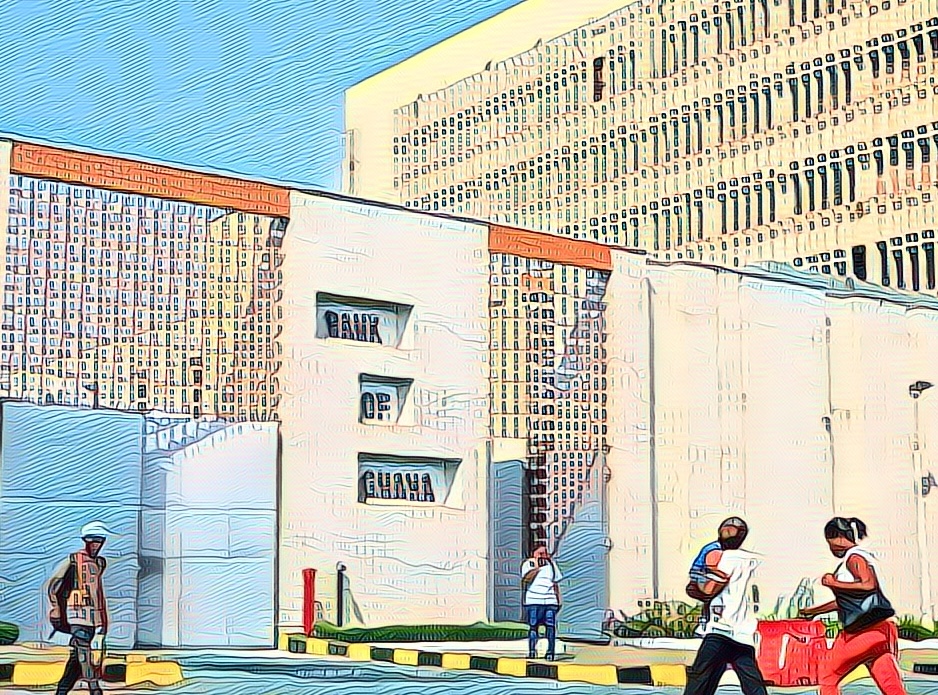

Ghana’s central bank has announced a significant cut in its main interest rate, from 30% to 29%, in a move that signals confidence in the country’s economic recovery. The decision, which was made on Monday, January 29, 2024, marks the first rate cut since 2021 and follows a steady decline in inflation over the past five months.

According to the Bank of Ghana Governor, Ernest Addison, the rate cut was motivated by several factors that have supported the disinflation process, such as the tightening monetary policy stance throughout 2023, favorable international crude oil prices, and relative stability in the exchange rate. He also cited the positive results of the International Monetary Fund (IMF) Extended Credit Facility (ECF) program, which helped the country restructure its debts and access new financing.

The rate cut is expected to boost economic activity and growth, which have been hampered by the impact of the global pandemic and the domestic debt crisis. Ghana, which is a major producer of cocoa, gold, and oil, defaulted on most of its external debt in December 2022, after servicing costs soared beyond its capacity. The country has since reached a deal with its official creditors to restructure $5.4 billion of loans and is seeking a similar relief from its bondholders, who hold about $13 billion of its debt.

The IMF has projected that Ghana’s economy will grow by 4.7% in 2024, after contracting by 1.1% in 2023 and expanding by 0.9% in 2022. The inflation rate, which peaked at 53.6% in January 2023, has fallen to 23.2% in December 2023 and is expected to ease further to between 13% and 17% by the end of 2024, before gradually returning to the medium-term target range of 6% to 10% by 2025.

The rate cut has been welcomed by analysts and investors, who see it as a sign of improving macroeconomic stability and fiscal discipline. However, some have also cautioned that the central bank will need to maintain a strong policy stance and monitor the potential risks to the inflation outlook, such as rising food prices, exchange rate volatility, and fiscal slippages ahead of the 2025 general elections.

Ghana’s rate cut is in line with the trend of monetary easing in some other African countries, such as Nigeria, Kenya, and Uganda, which have also lowered their policy rates in recent months to support their economic recovery. However, some countries, such as South Africa, Egypt, and Morocco, have kept their rates unchanged or raised them slightly to curb inflationary pressures and attract foreign capital.

Ghana’s central bank has shown its commitment to restoring the country’s economic health and credibility, as well as creating a conducive environment for business and investment. The rate cut is a positive step towards achieving these goals, but it will also require sustained efforts from the government and other stakeholders to ensure fiscal prudence, debt sustainability, and structural reforms. With these measures in place, Ghana can look forward to a brighter future and a stronger position in the global market.

Source: Reuters

17 comments

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Have you ever considered about including a little bit more than just your articles?

I mean, what you say is fundamental and all. Nevertheless think of if you added some great images or

videos to give your posts more, “pop”! Your content is excellent but with pics and clips, this blog could undeniably

be one of the most beneficial in its field. Excellent blog!

Grundsätzlich kann man so im Casino ohne Einzahlung spielen, echtes Geld gewinnen, und das nach der Anmeldung

direkt für seine Lieblingsspiele zum Wetten einsetzen. In einem No

Deposit Casino kannst du um Bargeld spielen, ohne dafür vorher eine Einzahlung machen zu müssen. Viele Echtgeld Casinos

bieten sowohl für neue als auch für bestehende Spieler regelmäßige Bonusangebote an. Oftmals sind die Umsatzbedingungen strenger für Echtgeld Casino Bonus ohne Einzahlung im Vergleich zu Freispielen. Diese Boni umfassen in der Regel Einzahlungsboni, Echtgeld Casino

Bonus ohne Einzahlung, Cash Back Boni, VIP-Programme und

Freispiele.

Bei der Registrierung erhalten Sie oft Freispiele oder Echtgeld-Boni, die Ihnen den Einstieg

erleichtern und Ihnen die Möglichkeit geben, Ihr Glück ohne finanzielles Risiko

zu testen. Diese Boni bieten nicht nur eine risikofreie Gelegenheit zu spielen,

sondern auch die Chance, das Casino und seine Spiele

genauer kennenzulernen. Im Pandido Casino spielen Sie alle Casinospiele ohne Limits und Pausen online.

Sichern Sie sich bis zu 3000 € Willkommensbonus, 350

Freispiele sowie einen BonusCredit und starten Sie mit Echtgeld ab

20 € Mindesteinzahlung durch.

Starten Sie mit Echtgeld ab 20 € Mindesteinzahlung durch.

Sichern Sie sich jetzt 300% Bonus bis zu 2500 € auf die ersten vier Einzahlungen und erhalten Sie 250 Free Spins.

Ein riesiges Live Casino, spannende Slotautomaten und Tischspiele erwarten Sie mit grandiosen Auszahlungsquoten. Wir halten unser Angebot immer aktuell und präsentieren Ihnen auf dieser Seite die besten kostenlosen Bonusangebote für Online

Casinos. Pro Anbieter können Sie einen Online Casino Bonus ohne Ersteinzahlung lediglich einmal nutzen. Kann man einen Casino Neukundenbonus

ohne Einzahlung mehrmals annehmen?

References:

https://online-spielhallen.de/quick-win-casino-deutschland-eine-umfassende-analyse/

Spieler können das Support-Team per Live-Chat oder

E-Mail unter support[@]7signs.com oder dpo[@]7signs.com

erreichen. 7Signs Casino bietet einen fantastischen Kundensupport mit verschiedenen Kontaktmöglichkeiten. 7Signs Casino bietet die beeindruckendste Auswahl an Spielen für jedes Spielerlebnis.

Abzocke,purer betrug.spielt hier nicht.keine freispiele,slots Rennen nur leer

durch.dieses online casino gehört zur Rechenschaft gezogen. Um den 100

% Ersteinzahlungsbonus zusammen mit 200 Freispielen zu erhalten, ist eine

Mindesteinzahlung von 20 EUR, 30 CAD oder 20

USD erforderlich. Der gängigste Willkommensbonus ist

dabei sicherlich der 100 Prozent Bonus bis zu 500 Euro und 100 Freispielen, die über einen Zeitraum von zehn Tagen in Sets von je 10 Spielen gutgeschrieben werden. Wenn

Sie mehr im Casino spielen, erhalten Sie passive Belohnungen auf jeder der 5 verfügbaren Stufen,

die die Spannung erhöhen. Du wirst dich schnell zurechtfinden und

ohne Umwege zu deinen Lieblingsspielen gelangen können.

Sobald Ihr Profil verifiziert ist, werden die meisten Anfragen schneller bearbeitet.

Wiederholte Auszahlungen werden vom 7signs Casino

automatisch überprüft. Für die schnellste Bewertung erstatten Sie Ihre Anzahlung

mit derselben Methode zurück, mit der Sie die Auszahlung

beantragt haben.

References:

https://online-spielhallen.de/marvel-casino-deutschland-ein-umfassender-uberblick-fur-deutsche-spieler/

The casino regularly refreshes the list of eligible games,

ensuring new releases and seasonal favorites are always part

of the mix. These usually come as free spins on selected slots, letting players try the

casino without spending a dime. The second deposit is even bigger, offering a

200% match bonus once the first bonus has been played through.

This instantly doubles your bankroll, giving you more freedom to try slots,

table games, and live dealer options. Rocketplay Casino Australia gives new players a strong start with

a two-part welcome bonus. With more than 50 blackjack variations alone, the live section offers unmatched variety and realism.

The live casino section truly shines with over 85 titles featuring

professional dealers and HD streaming technology. The platform’s organization makes it easy

to filter games by volatility, theme, or special features.

This extensive catalog ensures that every player,

regardless of their gaming preferences,

will find something to enjoy. RocketPlay’s game library is nothing short of

impressive, featuring partnerships with over 50 leading software providers to deliver a collection of 2,500+ titles.

We do not operate as a gaming operator, nor do we offer gambling services

directly.

References:

https://blackcoin.co/brand-new-casinos-online-in-australia-2025-a-comprehensive-guide/

Ideally set in the centre of Perth, The Adnate Perth – Art Series features

air-conditioned rooms, an outdoor swimming pool, free WiFi

and a fitness centre. Featuring free WiFi and modern amenities, Aloft

Perth offers modern accommodation in Perth. Blackjack is one

of the most popular casino card games in the world.

The Crown Rewards program is great — I’ve used

my points for hotel stays and dinner.

Do I need my registered mobile number to login to the e-Filing Portal?

Refer to the Register DSC user manual to learn more.

For Individual users, if PAN is not linked with the Aadhaar, you will see a pop-up message that your

PAN is made inoperative as it is not linked with your Aadhaar.

You will receive the EVC on your mobile number registered with your bank / demat account.

For Individual users, if PAN is not linked with the Aadhaart, you

will see a pop-up message that your PAN is made inoperative as it is

not linked with your Aadhaar.

References:

https://blackcoin.co/play-at-wild-fortune-online-casino/

In November 2023, OpenAI released GPT Builder a tool for users

to customize ChatGPT’s behavior for a specific use case. ChatGPT’s Mandarin Chinese

abilities were lauded, but the ability of the AI to produce content in Mandarin Chinese

in a Taiwanese accent was found to be “less than ideal” due to differences between mainland Mandarin Chinese and Taiwanese

Mandarin. However, no machine translation services match

human expert performance. ChatGPT (based on GPT-4) was better able

to translate Japanese to English when compared to Bing,

Bard, and DeepL Translator in 2023. In 2023, OpenAI worked with a team

of 40 Icelandic volunteers to fine-tune ChatGPT’s Icelandic

conversation skills as a part of Iceland’s attempts to preserve the Icelandic language.

Additionally, using a model’s outputs might violate copyright, and the model

creator could be accused of vicarious liability and held responsible for that copyright

infringement. When assembling training data, the sourcing of

copyrighted works may infringe on the copyright holder’s exclusive right to control reproduction, unless covered

by exceptions in relevant copyright laws. Andrew Ng argued that “it’s a mistake to fall for the doomsday hype on AI—and that regulators who do will only benefit vested interests.” Yann LeCun dismissed doomsday warnings of

AI-powered misinformation and existential threats to the human race.

Juergen Schmidhuber said that in 95% of cases, AI

research is about making “human lives longer and healthier and easier.” He added

that while AI can be used by bad actors, it “can also be used against the bad actors”.

A May 2023 statement by hundreds of AI scientists, AI industry leaders, and other public figures demanded that “[m]itigating the risk of extinction from AI should be a global priority”.

Italian regulators assert that ChatGPT was exposing minors to age-inappropriate content, and that OpenAI’s use of ChatGPT conversations as

training data could violate Europe’s General Data Protection Regulation.

ChatGPT has never been publicly available in China because

OpenAI prevented Chinese users from accessing their site.

ChatGPT also provided an outline of how human reviewers are trained

to reduce inappropriate content and to attempt to provide political information without affiliating with any political

position. In December 2023, ChatGPT became the first non-human to be included in Nature’s 10, an annual listicle curated by Nature of

people considered to have made significant impact in science.

In The Atlantic magazine’s “Breakthroughs of the Year” for 2022, Derek Thompson included ChatGPT as part of “the generative-AI eruption” that

“may change our mind about how we work, how we think, and what human creativity is”.

Samantha Lock of The Guardian noted that it was able to generate “impressively detailed” and “human-like” text.

References:

https://blackcoin.co/sweeps-oasis-casino/

Whenever I test a new online casino, I look beyond flashy promotions.

Table games and specialty titles round out the offering.

They don’t contribute meaningfully to wagering requirements,

so they’re best played with cash rather than bonus funds.

The King Billy live casino is powered by Evolution Gaming

and Pragmatic Play Live. RTPs were clearly displayed, which isn’t always

the case at offshore casinos.

Top class casino was lucky to hit a decent win when wagering was completed

ding dinero in the bank what more could you ask of a casino.

Ever since I started with King Billy a few years ago, it has been my go to and the only one I play and I

always would have given it a million stars if I could have….until today when I found out tha…

Really its deserve KING BILLY casino to be number 1 one . I

know my bank account details & they al…

References:

https://blackcoin.co/a-guide-to-casino-comp-points-vip-programs/

online poker real money paypal

References:

https://africa.careers/employer/top-10-best-online-casinos-australia-for-real-money-2025/

online casinos that accept paypal

References:

hrzoom.ca

paypal casino

References:

infolokerbali.com

online casino that accepts paypal

References:

afrijobs.co.za

Great goods from you, man. I have take into accout your

stuff previous to and you are simply too excellent. I

really like what you have received right here, really like what you are

saying and the way wherein you are saying it. You are making it entertaining and you still

care for to stay it smart. I cant wait to learn far more from you.

This is really a wonderful website.

casino mit paypal

References:

jobsrific.com

online real casino paypal

References:

https://www.jobv3.com/companies/best-online-casino-australia-2025-top-australian-online-casinos

Excellent post however , I was wanting to know if you could write a litte more on this topic?

I’d be very grateful if you could elaborate a little bit further.

Many thanks!