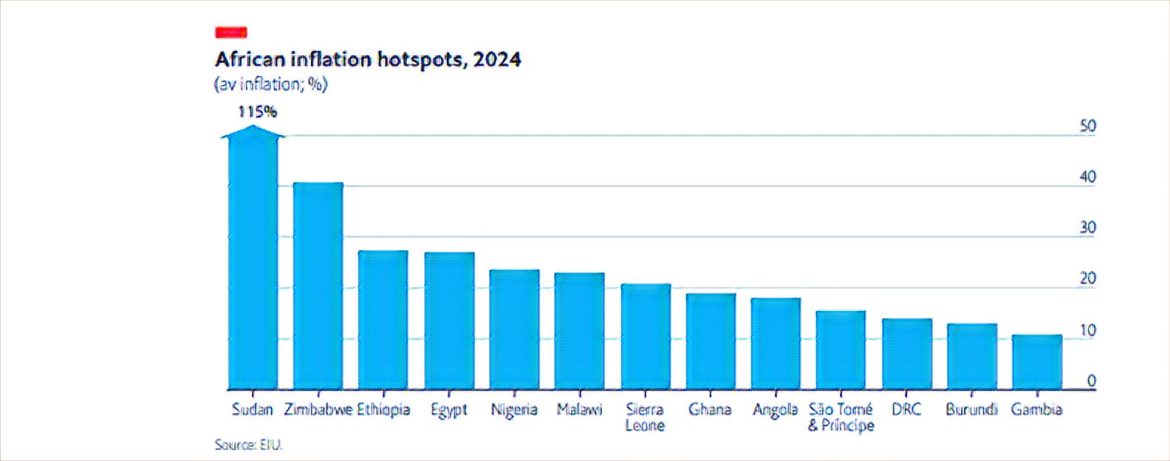

Ghana is expected to see a significant decline in its inflation rate from an average of 38% in 2023 to 18% in 2024, according to a report by The Economist Intelligence Unit (EIU). The EIU is a UK-based research and analysis firm that provides economic and political forecasts for countries around the world.

The report, which was published on November 20, 2023, said that Ghana’s inflation rate will be the eighth highest in Africa in 2024, but lower than that of Nigeria, which will have an inflation rate of 22%. The report attributed the easing of inflationary pressures in Ghana and most African countries to the expected fall in oil prices, which have been the main driver of consumer price inflation in 2023.

Oil prices have surged in 2023 due to the global recovery from the COVID-19 pandemic, which boosted demand for energy, and the supply disruptions caused by geopolitical tensions and natural disasters. According to the International Monetary Fund (IMF), the average price of crude oil in 2023 was $87.5 per barrel, up from $41.3 per barrel in 2020. The IMF projected that the oil price will drop to $75.8 per barrel in 2024 and $67.9 per barrel in 2025.

The high oil price has had a negative impact on Ghana’s economy, which is a net importer of oil. The country’s trade balance deteriorated from a surplus of 2.9% of GDP in 2020 to a deficit of 3.1% of GDP in 2023, according to the World Bank. The country’s fiscal deficit also widened from 11.7% of GDP in 2020 to 14.2% of GDP in 2023, as the government increased spending to mitigate the effects of the pandemic and the oil shock. The country’s public debt rose from 76.1% of GDP in 2020 to 88.9% of GDP in 2023, raising concerns about debt sustainability and credit ratings.

The high inflation rate also eroded the purchasing power of consumers and businesses, reducing their demand for goods and services. The country’s real GDP growth slowed down from 4.6% in 2020 to 3.2% in 2023, according to the World Bank. The country’s poverty rate increased from 23.4% in 2019 to 26.2% in 2023, according to the Ghana Statistical Service (GSS).

The EIU report said that the lower inflation rate in 2024 will be a welcome relief for policymakers and households, as it will improve the macroeconomic stability and the living standards of the people. The report also said that the lower inflation rate will create room for the central bank to lower the policy rate, which has been kept at 25% since March 2023, to stimulate economic activity and investment. The report projected that the country’s real GDP growth will rebound to 4.8% in 2024 and 5.2% in 2025, as the domestic and external demand recover.

However, the report cautioned that the inflation rate will still remain high and volatile in 2024, as the country faces several challenges, such as the uncertainty over the COVID-19 situation, the political tensions ahead of the 2024 general elections, the structural weaknesses in the energy sector, and the social unrest over the rising cost of living and the lack of public services. The report urged the government to implement prudent fiscal and monetary policies, as well as structural reforms, to enhance the resilience and competitiveness of the economy.

The report also advised the government to seek debt relief from its creditors, as part of the G20’s Common Framework for Debt Treatments, which aims to help low-income countries cope with the debt burden amid the pandemic. The report said that the debt relief will help the country to free up fiscal space for priority spending, such as health, education, and infrastructure, and to restore the confidence of investors and donors.

The report concluded that Ghana has the potential to achieve a more sustainable and inclusive growth path if it can overcome the current challenges and seize the opportunities offered by the regional and global markets, such as the African Continental Free Trade Area (AfCFTA) and the digital transformation.

Source: MyJoyOnline