KEY POINTS

- VAT reform ends years of business frustration.

- Consolidation reduces direct costs for local firms.

- Simplified system allows input VAT deductions easily.

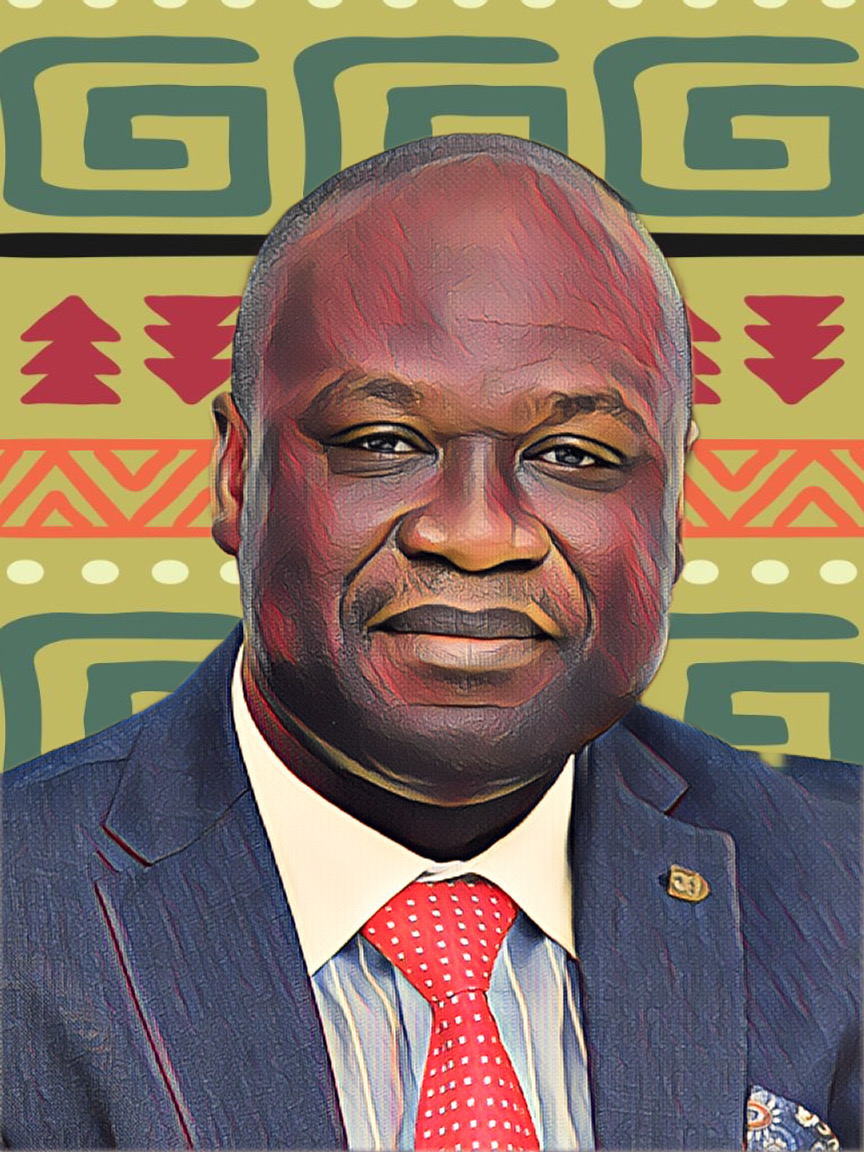

The Ghana National Chamber of Commerce and Industry (GNCCI) has welcomed the government’s overhaul of the Value Added Tax system, calling it a major relief for local businesses. Chief Executive Mark Badu Aboagye said companies had been advocating for the reform for nearly four years.

“Largely, this is one of our major concerns for the past three to four years, and in all the budgets, one of our major inputs is for the VAT to be reformed,” he said. The optimism first emerged last year when the government hinted at changes, but progress stalled for nearly a year. According to Badu Aboagye, the latest budget finally delivers on that promise, resolving long-standing frustrations in the business community.

Ghana VAT reform simplifies compliance and reduces costs

The old VAT system combined standard VAT with straight-line levies, making compliance difficult and costly for businesses. “Some of our members were not opposed to paying taxes, but the complexity of calculation was a major challenge,” he said.

Under the previous structure, levies such as NHIL, GET Fund, and COVID-related charges became direct costs because they could not be claimed as input VAT. Enterprises can now deduct these sums from their VAT liabilities because of the merger. This lowers direct costs and makes it easier for enterprises to manage their cash flow.

Businesses anticipate smoother operations under Ghana VAT reform

Badu Aboagye said the simplified system allows companies to calculate output VAT, input VAT, and deductions clearly. “Now, when you pay your 20 percent, you know exactly how to compute your output and input VAT and what to remit to government,” he explained.

While price effects may follow later, the immediate benefit is clarity and predictability for businesses. The GNCCI expects that the reforms will not only enhance compliance but also boost competitiveness by reducing administrative burdens.

“The system is now clear, straightforward, and easier for our members to work with,” Badu Aboagye concluded, calling it a “major win” for local enterprises.