Ghana’s government has announced a series of tax waivers for various sectors and products in its 2024 budget, which aims to lower taxes and increase the tax net. The tax waivers are part of the government’s COVID-19 Alleviation and Revitalisation of Enterprises Support Program, which seeks to cushion the impact of the pandemic and stimulate economic recovery.

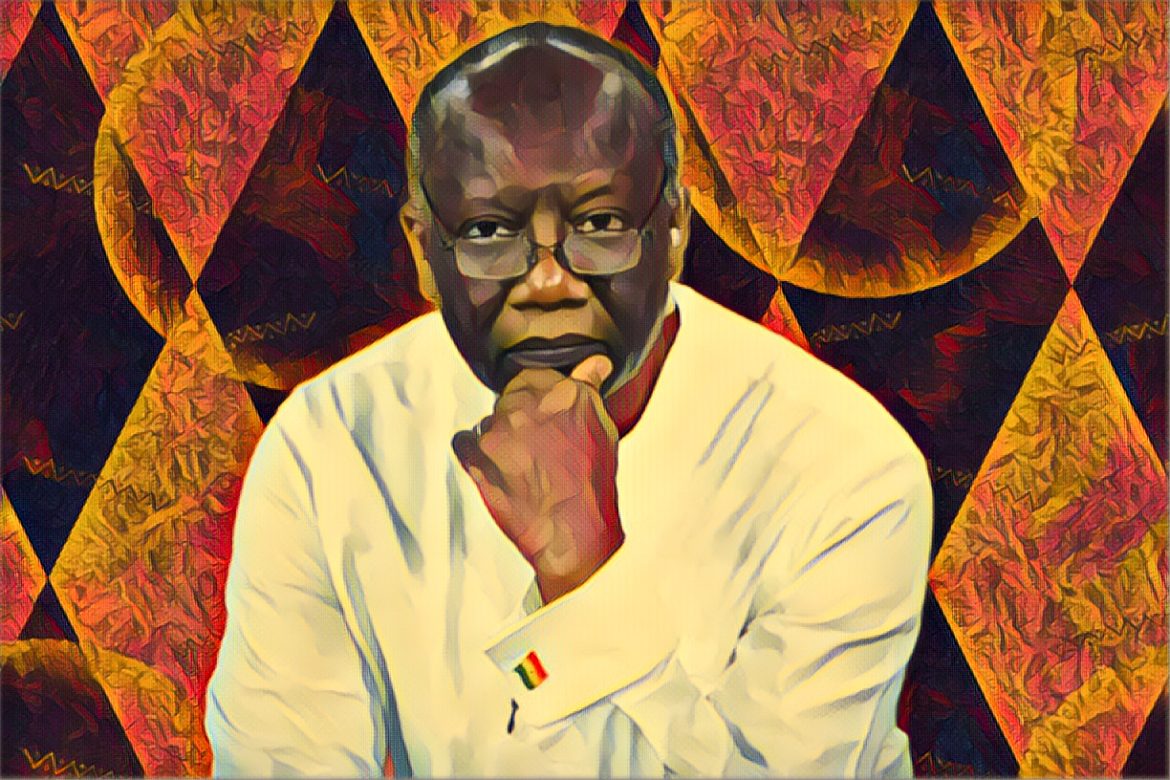

According to the Minister of Finance, Ken Ofori-Atta, who presented the budget to Parliament on November 15, 2023, the tax waivers include:

- Extending the zero rate of VAT on locally manufactured African prints for two more years

- Waiving import duties on the import of electric vehicles for public transportation for eight years

- Waiving import duties on semi-knocked down and completely knocked down electric vehicles imported by registered EV assembly companies in Ghana for eight years

- Extending the zero rate of VAT on locally assembled vehicles for two more years

- Zero rating VAT on locally produced sanitary pads

- Granting import duty waivers for raw materials for the local manufacture of sanitary pads

- Granting exemptions on the importation of agricultural machinery equipment and inputs and medical consumables, raw materials for the pharmaceutical industry

- Introducing a VAT flat rate of 5 per cent to replace the 15 per cent standard VAT rate on all commercial properties to simplify administration.

The minister said that the government is committed to working with the Ghana Revenue Authority to improve tax compliance and broaden the tax base. He also said that the government will implement structural reforms and expenditure rationalisation measures to reduce the fiscal deficit and public debt, which have increased due to the pandemic.

The 2024 budget has been welcomed by some stakeholders, such as the Association of Ghana Industries, which said that the tax waivers will help to reduce the cost of doing business and enhance the competitiveness of local industries. However, some critics, such as the Minority in Parliament, have questioned the feasibility and sustainability of the budget, citing the high debt burden, inflation, and exchange rate volatility.

The budget comes at a time when Ghana’s economy is facing significant challenges due to the global and domestic shocks caused by the pandemic. According to the World Bank, Ghana’s GDP growth slowed to 3.3 per cent in 2022 from 5.4 per cent in 2021 and is projected to fall further to 1.7 per cent in 2023 before recovering to 3 per cent in 2024. Inflation rose to 31.5 per cent in 2022 from 10 per cent in 2021, driven by food and energy prices and currency depreciation. The fiscal deficit widened to 9.3 per cent of GDP in 2022 from 9.2 per cent in 2021, while the public debt reached 93.5 per cent of GDP in 2022 from 82 per cent in 2021.

Despite these challenges, the government remains optimistic that the 2024 budget will help to restore fiscal stability, boost economic growth, and improve the welfare of Ghanaians. The budget also aligns with the government’s vision of building a Ghana Beyond Aid, which entails enhancing domestic resource mobilisation, promoting economic diversification, and fostering social inclusion.

Source: GhanaWeb