Ghana’s traders have voiced their opposition to a new 15% value-added tax (VAT) on electricity, saying it will affect their operations and increase the cost of living.

The Ghana Union of Traders Association (GUTA), which represents thousands of small and medium-sized enterprises, has called on the government to improve its tax collection system instead of imposing more taxes on the people.

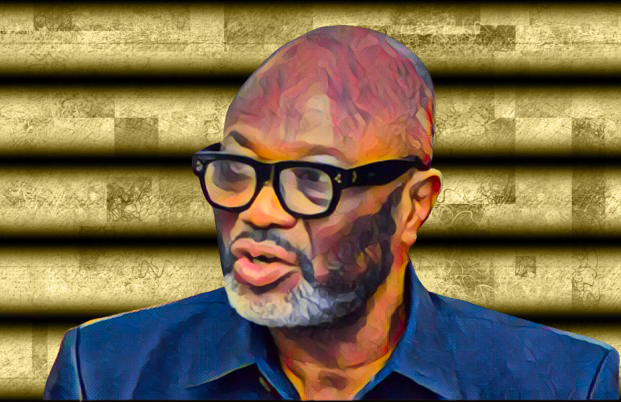

“We cannot support this new tax on electricity. It will make our businesses uncompetitive and increase the burden on the ordinary Ghanaian,” said Dr. Joseph Obeng, the president of GUTA, in an interview with Al Jazeera.

He said the government should modernize its road tolls, expand its tax base, and eliminate corruption and leakages in the revenue system.

“Why can’t we use technology to collect road tolls? That will be more efficient and transparent than the current manual system. We also need to bring more people into the tax net, especially those in the informal sector,” he said.

According to GUTA, the new tax on electricity will also affect the prices of goods and services, as businesses will pass on the extra cost to consumers.

“This will worsen the already high inflation and hardship in the country. Electricity is a basic necessity, not a luxury. We should not be taxed for using it,” Obeng said.

The new tax on electricity was announced by the finance minister, Ken Ofori-Atta, in his 2024 budget statement to parliament last month. He said the tax was part of the government’s efforts to raise more revenue to finance its development agenda and reduce its fiscal deficit.

He also asserted that the tax would enable the government to settle its debts with the power sector, which has suffered from frequent blackouts and inefficiencies.

However, the tax has sparked public outcry and criticism from various stakeholders, including civil society groups, opposition parties, and labor unions.

They have accused the government of being insensitive to the plight of the people, who are already struggling with the effects of the global economic downturn and the coronavirus pandemic.

They have also questioned the government’s commitment to improving the power sector, which they say has not seen any significant reforms or investments despite previous tax increases and loans.

The government, however, has defended the tax, saying it is necessary and temporary. It has also assured the public that it will cancel the tax after it completes its negotiations with the International Monetary Fund (IMF), which has advised the government to broaden its tax base and reduce its expenditure.

The government has also said it will consult with the stakeholders and address their concerns before implementing the tax.

Meanwhile, GUTA has urged the government to listen to the voice of the people and scrap the tax or face the consequences.

“We are ready to resist this tax by any means possible, we will not sit down and watch our businesses collapse and our livelihoods destroyed. We will mobilize our members and the public to protest and boycott the payment of this tax,” Obeng said.

He also appealed to the IMF and other development partners to support the government in finding alternative sources of revenue that would not hurt the economy and the people.

“We are not against paying taxes, but we want fair and reasonable taxes that will not kill our businesses and our spirit. We want taxes that will promote growth and development, not stagnation and poverty,” he said.

He expressed hope that the government will heed their call and reconsider its decision, in the interest of the nation and its future.

Source: Modern Ghana

2 comments

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!