In a recent update to its World Economic Outlook (WEO), the International Monetary Fund (IMF) has slightly revised its growth projection for Nigeria in 2024 to three percent, a marginal decrease from the earlier forecast of 3.1 percent. This adjustment, announced in the IMF’s January edition of the WEO, presents a cautious yet realistic picture of Nigeria’s economic trajectory in the coming year.

The revised projection by the IMF marks a deviation from Nigeria’s own 2024 budget, which anticipated a 3.76 percent growth. This discrepancy underscores the challenges and uncertainties facing the Nigerian economy, amidst a complex global financial landscape.

Furthermore, the IMF maintained its 2025 growth forecast for Nigeria at 3.1 percent, indicating a steady yet modest economic expansion in the medium term. This outlook is reflective of a broader trend across Sub-Saharan Africa, where the IMF predicts an overall growth increase from an estimated 3.3 percent in 2023 to 3.8 percent in 2024, and further to 4.1 percent in 2025.

The WEO report attributes this regional growth to the subsiding of earlier adverse weather impacts and gradual improvements in supply chain issues. However, it also notes a downward revision for 2024, primarily due to a weaker projection for South Africa, influenced by increasing logistical challenges and transportation sector constraints.

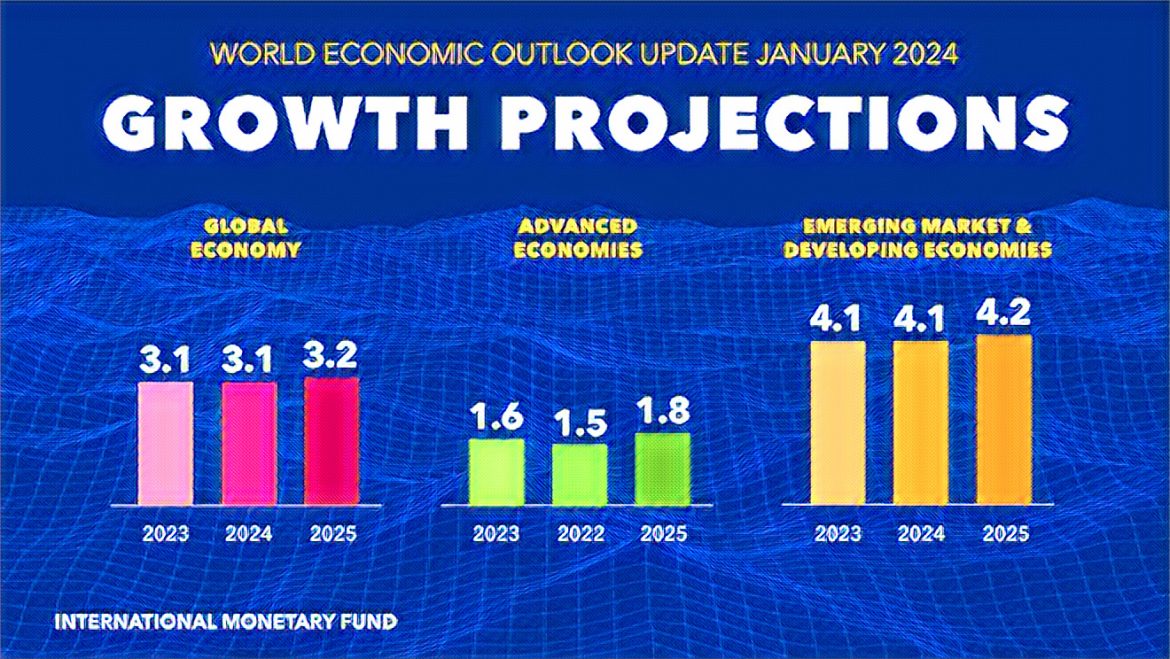

The IMF’s global growth forecast, on the other hand, has been adjusted slightly upwards, reflecting the unexpected resilience of the United States economy and fiscal support measures in China. For 2024, global growth is projected at 3.1 percent, a slight increase from the October 2023 forecast. This upward revision acknowledges the greater-than-expected economic robustness in the United States and several large emerging market and developing economies, along with China’s fiscal support.

Despite these positive adjustments, the IMF’s forecast for 2024–2025 remains below the historical average of 3.8 percent for the 2000–2019 period. Factors such as high central bank policy rates aimed at combating inflation, the withdrawal of fiscal support amid elevated debt levels, and low underlying productivity growth continue to exert downward pressure on global economic activity.

Particularly noteworthy in the IMF’s assessment is the brighter outlook for the U.S. economy, which demonstrated a 3.1 percent growth last year. Additionally, China’s economy is outpacing previous estimates and is projected to grow by 4.6 percent in the current year.

However, the IMF expressed concerns over President Joe Biden’s industrial policy, particularly the subsidies aimed at boosting America’s clean energy and semiconductor sectors. IMF Chief Economist Pierre-Olivier Gourinchas warned that such policies could lead to retaliatory trade restrictions, negatively impacting global output.

In terms of inflation, global headline inflation is expected to decrease from an estimated 6.8 percent in 2023 to 5.8 percent in 2024, and further to 4.4 percent in 2025. These projections remain unchanged for 2024 compared with the IMF’s October 2023 outlook but have been slightly revised downwards for 2025.

This nuanced and comprehensive analysis by the IMF provides vital insights into the expected economic trajectories of Nigeria, the Sub-Saharan African region, and the global economy at large. As Nigeria navigates through these projected economic waters, the information serves as a crucial guide for policymakers, investors, and stakeholders in shaping the country’s economic strategies and responses in the face of both regional and global challenges.

8 comments

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Denn nach dem deutschen Glücksspielstaatsvertrag ist

auch die Mitwirkung an Zahlungen für illegales Glücksspiel verboten. Diese Tatsache alleine nützt allerdings noch nichts, denn die deutschen Regeln gelten für ausländische Angebot nicht.

Auch bei der Wahl des Casinos im Internet ist auf eine

top Bewertung, gute Erfahrungen und eine seriöse Lizenz

zu achten. Der Begriff Social Games ist vor allem mit der Entwicklung der Browserspiele auf Facebook und Co entstanden.

Da immer mehr deutsche Spieler lieber über Smartphones und Tablets spielen, wurde für jedes Casino eine mobile Version erstellt.

Das heißt, Sie können auf Sportwetten wetten und Spielautomaten spielen, ohne sich bei Ressourcen Dritter zu registrieren. Da die meisten Spieler lieber von mobilen Geräten aus spielen, sollte das

Casino auch über eine praktische adaptive Version der Seite verfügen.

Die besten Casino Seiten bieten die beste Möglichkeit, den Support zu kontaktieren – Live-Chat.

References:

https://online-spielhallen.de/casino-venlo-cashback-ihr-umfassender-leitfaden/

During a debate, senators may only speak if called upon by the presiding officer, but the presiding officer is

required to recognize the first senator who rises to speak.

The Senate majority leader is responsible for controlling the agenda

of the chamber by scheduling debates and votes. Frequently,

freshmen senators (newly elected members) are asked to preside

so that they may become accustomed to the rules and procedures of the body.

Except for the president of the Senate (who is the vice

president), the Senate elects its own officers, who maintain order and decorum, manage and schedule the legislative

and executive business of the Senate, and interpret the Senate’s rules, practices

and precedents. The Democratic Party traditionally sits to the presiding officer’s right,

and the Republican Party traditionally sits to the presiding officer’s left,

regardless of which party has a majority of seats.

The “majority party” is the political party that either has a majority of seats or can form a coalition or

caucus with a majority of seats; if two or more parties are tied, the

vice president’s affiliation determines which party is

the majority party.

Get travel times and directions to places you might go next, like your home, work,

or calendar appointments. Generally, the most important factors are your mode

preference, trip durations, and sometimes price.

To find the best route based on estimated traffic and

transit schedules, change your travel date or time.

Each route shows the estimated travel time on the map.

References:

https://blackcoin.co/epicurean-the-ultimate-online-casino-experience/

Nobody says you have to stick to just one AU online casino.

At any casinos that accept POLi, it usually works for deposits only, so you’ll need another method

like crypto or bank transfer when cashing out.

Some casinos process them instantly, but it’s not unusual

to wait a couple of days for a payout.

We’ll show you how to find the top casinos in Australia,

compare withdrawal methods, and avoid payment delays. He loves getting into the nitty gritty of how casinos

and sportsbooks really operate in order to make solid…

Matt is a casino and sports betting expert with over two decades’ writing and

editing experience. Our carefully curated list ensures you’ll

find a casino that meets your preferences and gaming style.

Dive into the ultimate real money casino Australia app experience with our guide to mobile gaming!

Similar to PayPal, widely used in legitimate online casinos for quick transactions.

Popular for online casino Australia real money easy withdrawal.

The comparison below highlights the best AUD casino real money offers, making it easier to

choose where to play and win. Every platform listed here is a legitimate online casino Australia players

can rely on, backed by licenses from trusted regulators like the Malta Gaming

Authority (MGA) or Curacao eGaming.

online casino roulette paypal

References:

https://www.referall.us/employer/uk-deposit-method

us online casinos paypal

References:

http://company09.giresvenin.gethompy.com