KEY POINTS

- The Black Volta gold project secured $37 million in processing equipment.

- First production at the Black Volta gold project is targeted for 2027.

- The mine could create about 1,700 long-term jobs in northern Ghana.

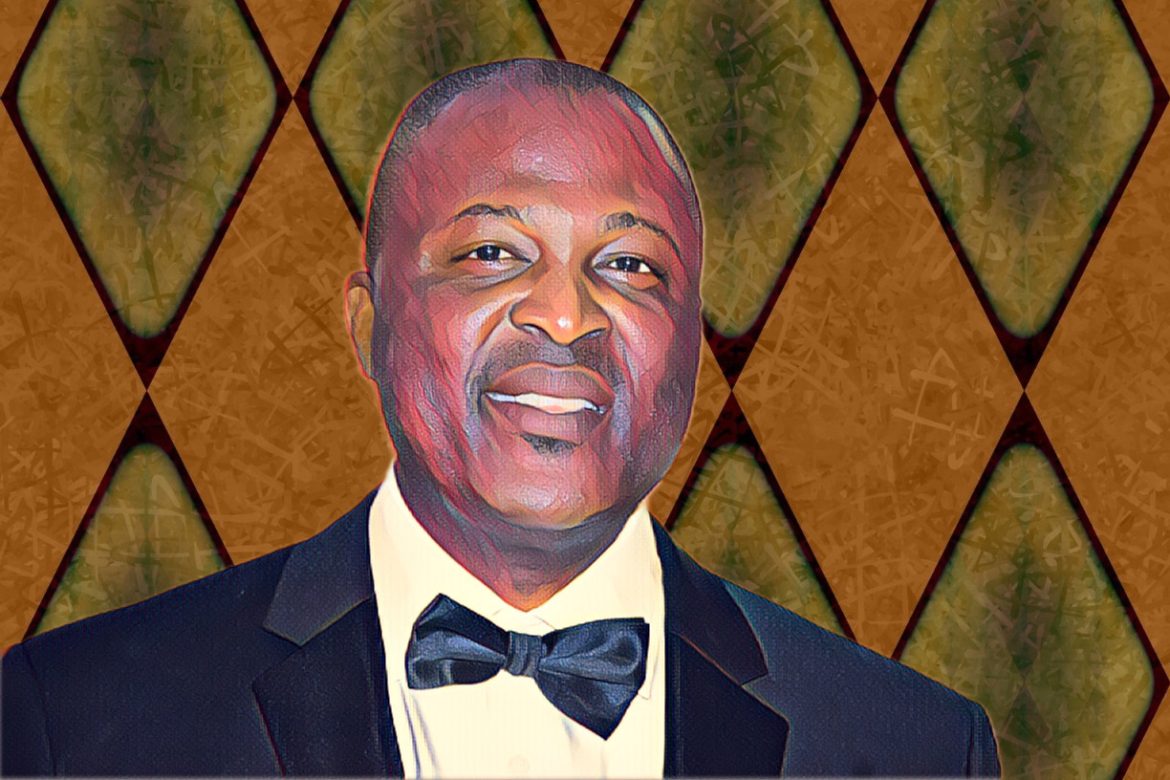

Ghanaian businessman Ibrahim Mahama has taken a decisive step toward bringing the Black Volta gold project into production, signing a $37 million equipment supply agreement weeks after completing a $100 million acquisition of Azumah Resources Ghana Ltd.

The deal, signed by Azumah Resources and Danish mining technology firm FLSmidth, marks the transition from planning to on-site execution at the project in Ghana’s Upper West Region. Backed by Mahama’s Engineers & Planners Group, Azumah is now targeting first gold output by 2027, with the equipment contract removing one of the most significant execution risks.

Mahama attended the signing ceremony, signaling the strategic importance of the agreement as the company accelerates development following years of delays at the asset.

Black Volta gold project enters execution phase

Under the agreement, FLSmidth will supply long-lead processing equipment required for the mine’s plant, including gyratory crushers, SAG and ball mills, screening systems, pumps and refinery units. The contract also covers engineering support, installation supervision, commissioning services and on-site training for operational staff.

Delivery of the equipment is scheduled for 2026. Some components have manufacturing lead times of up to 46 weeks, making early financial commitment critical to keeping the Black Volta gold project on schedule.

Azumah Resources director Noel Nii Addo said the company selected FLSmidth for its global track record in mining process technologies. He described the $37 million order as a clear signal that the project is moving toward large-scale commercial production rather than remaining a long-term development plan.

The project targets 2027 output

Addo said commercial gold production will begin about 21 months after the company delivers the equipment. At full operation, the mine will create roughly 1,700 long-term jobs, with priority given to communities around the Wa area.

Developers plan the Black Volta mine with an initial life of about 11 years. Explorers have surveyed only about 20 percent of the concession so far, leaving room for additional drilling to extend production and deepen the project’s economic impact over time.

According to Billionaires Africa, the agreement builds on Mahama’s October acquisition of Azumah Resources, which gave Engineers & Planners control of gold concessions that had remained largely undeveloped. Founded in 1997, Engineers & Planners has grown into one of Ghana’s largest indigenous engineering and construction firms, employing more than 4,000 people across West Africa.

For Mahama, the Black Volta gold project marks a strategic shift from contract services into asset ownership, positioning his group deeper within Ghana’s gold industry as policymakers push for stronger local participation.