KEY POINTS

-

BoG to launch secular non-interest banking framework by 2025.

-

Model ensures neutrality and bans religious branding in finance.

-

Two-tier licence structure promotes competition and innovation.

The Bank of Ghana (BoG) is finalising a comprehensive framework for non-interest banking designed to expand financial inclusion while preserving the country’s secular and market-neutral financial identity.

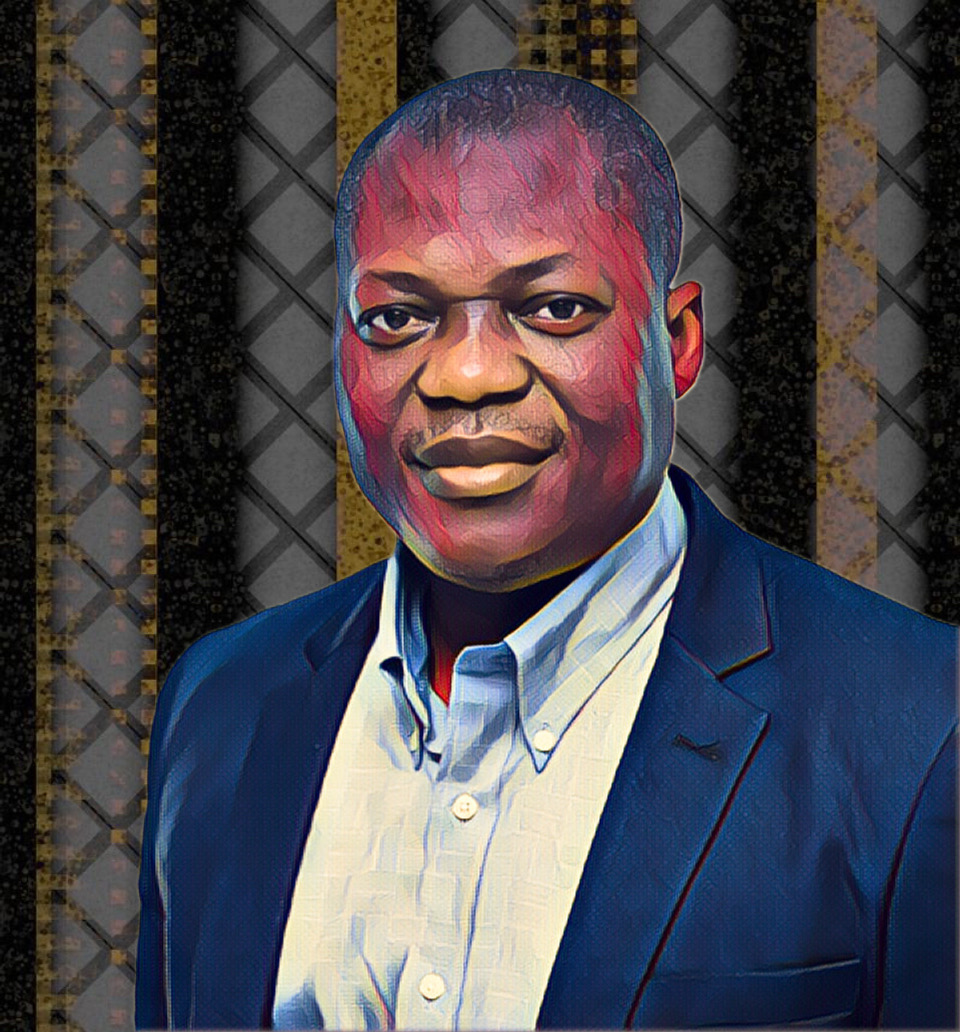

Professor John Gatsi, Advisor to the Governor on Non-Interest Banking and Finance, said the framework is in its final validation phase and will soon go to the Governor for approval.

Speaking at a webinar hosted by the Chartered Institute of Bankers (CIB) Ghana, Gatsi said the Bank of Ghana will roll out the plan in phases, initially leaving out microfinance, rural, and community banks.

“The intention is to start well, have control, and manage before escalating,” he explained, noting that the gradual rollout will allow the regulator to address early implementation challenges and strengthen compliance systems before expansion.

Non-interest banking built on secular integrity principles

A central feature of the non-interest banking framework is the preservation of Ghana’s secular character. Prof. Gatsi emphasised that no institution operating under the model will be allowed to use names or branding suggesting religious affiliation, whether Islamic, Christian, or otherwise.

“We must preserve neutrality of the market,” he said. “Non-interest banking in Ghana will run on ethical finance and inclusivity, not religion,” he said.

He added that the framework rests on the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930), ensuring compliance with prudential standards on anti-money laundering, liquidity management, and capital adequacy.

Liquidity management for non-interest institutions, he noted, will rely on asset-backed structures and risk-sharing mechanisms instead of conventional interest-based instruments but must still meet the same prudential benchmarks.

Two licensing tiers and cross-sector collaboration

Under the proposed model, BoG will issue two licence types: one for conventional banks to operate non-interest “windows,” and another for full-fledged non-interest banks offering products solely within that framework.

Prof. Gatsi said these measures would promote innovation and competition while avoiding market fragmentation.

The framework will extend to capital markets and insurance, with BoG collaborating with the Securities and Exchange Commission (SEC) and the National Insurance Commission (NIC) to create harmonised guidelines for Sukuk (non-interest bonds) and Takaful (non-interest insurance).

“We want the banking, capital market, and insurance systems to evolve together, not in isolation,” he said.

Governance and global benchmarks in non-interest banking

Prof. Gatsi outlined a two-tier governance structure, requiring each participating institution to establish an internal committee to vet products while BoG’s central oversight body validates compliance. “Governance is at the heart of non-interest banking,” he said.

To support implementation, BoG will host a capacity-building programme on December 1, 2025, covering Sukuk structuring, non-interest product design, licensing, and governance models.

He said Standard Chartered data shows global Islamic finance assets passed $5 trillion in 2024 and could climb to $7.5 trillion by 2028, while the Sukuk market may grow to $1.295 trillion in 2025.

“This is not just an experiment,” Prof. Gatsi said. “It’s about deepening financial inclusion and creating space for alternative finance aligned with Ghana’s secular and regulatory principles.”