KEY POINTS

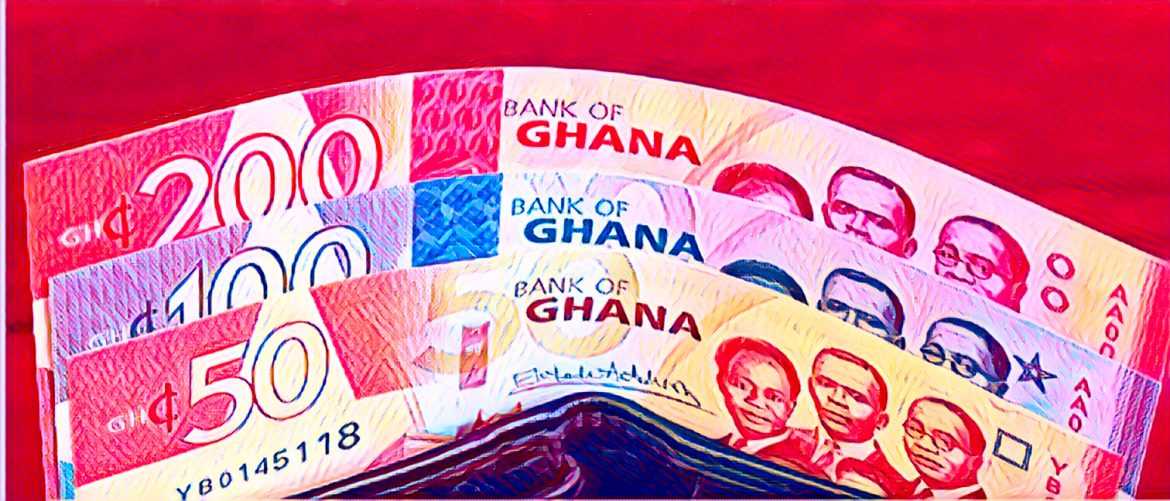

- The Ghana cedi closes 2025 at its strongest level in 10 years, reversing typical year-end depreciation.

- Reduced import pressure and increased diaspora forex inflows contributed to the currency’s stability.

- Businesses benefit from improved exchange rate predictability, aiding operational planning and pricing strategies.

The Ghana cedi is at its strongest point in ten years as 2025 comes to a close. This is a unique boost for the country’s private sector as the holiday season comes to an end.

Unlike what usually happens at the end of the year, when the local currency weakens because more people want to exchange it for foreign currency, the cedi has stayed stable and even gotten stronger against major world currencies.

Comparative performance: a currency change

Market data shows how much the Ghana cedi has recovered since the end of 2024. Last week, the US dollar was for GHȼ11.50, the British pound was worth GHȼ15.36, and the Euro was worth GHȼ13.47 on the interbank market.

The dollar was for GHȼ11.11, the pound was about GHȼ15.00, and the Euro was worth GHȼ13.08 by the end of this last week of December. This performance is very different from December 2024, when the dollar was for GHȼ14.71, the pound was worth GHȼ18.49, and the Euro was worth GHȼ15.33. This shows how strong the cedi was at the end of the year.

Analysts say that the currency’s performance is due to a mix of good fiscal and macroeconomic reasons. Ghana has a current account surplus, which is helped by strong capital and finance account balances. This lets the Bank of Ghana keep the exchange rate stable.

Less pressure to import and money coming in from the diaspora

Two specific things that happened at the conclusion of the year helped the cedi. Businesses finished their holiday import cycles early, which lowered demand for foreign currency late in the season. This has led to less pressure on imports. Also, a lot of money has come in from Ghanaians living abroad over the year-end holidays, which are part of the “Beyond the Return” celebrations. This has greatly increased the amount of dollars, pounds, and euros available in the country.

The stability of the currency is important for businesses in the real world. Importers, manufacturers, and merchants that do business across borders and need stable currency rates to manage their prices and operations can now make strategic decisions with more certainty. A market observer said, “The improved stability is a relief for businesses that rely heavily on predictable exchange rates for planning, pricing, and cross-border transactions.” Analysts say that this trend could also assist cut the overall cost of doing business in the first quarter of 2026.

As the year comes to an end, both traders and consumers are feeling hopeful. People who have seen their buying power decrease over time because of inflation and currency devaluation are hopeful that the cedi’s resilience is a sign of a long-term turn toward macroeconomic stability.

Currency in the middle of December 2025 The US dollar ($) at the end of 2025 and the end of 2024 GH₵11.50, GH₵11.11, and GH₵14.71; GB Pound (£) GHȼ15.36, GHȼ15.00, and GHȼ18.49 Euro (€) GHȼ13.47 GHȼ13.08 GHȼ15.33

The cedi’s performance is a good indicator for the end of 2025. It gives businesses a chance to plan for the future, the economy a chance to grow, and investors a chance to feel more confident as Ghana approaches 2026.