KEY POINTS

- Ghana’s heavy borrowing has not resulted in expected economic growth.

- Professor Quartey urges a 60% debt ceiling and investment reforms.

- Weak project appraisal and monitoring hinder effective fund utilization.

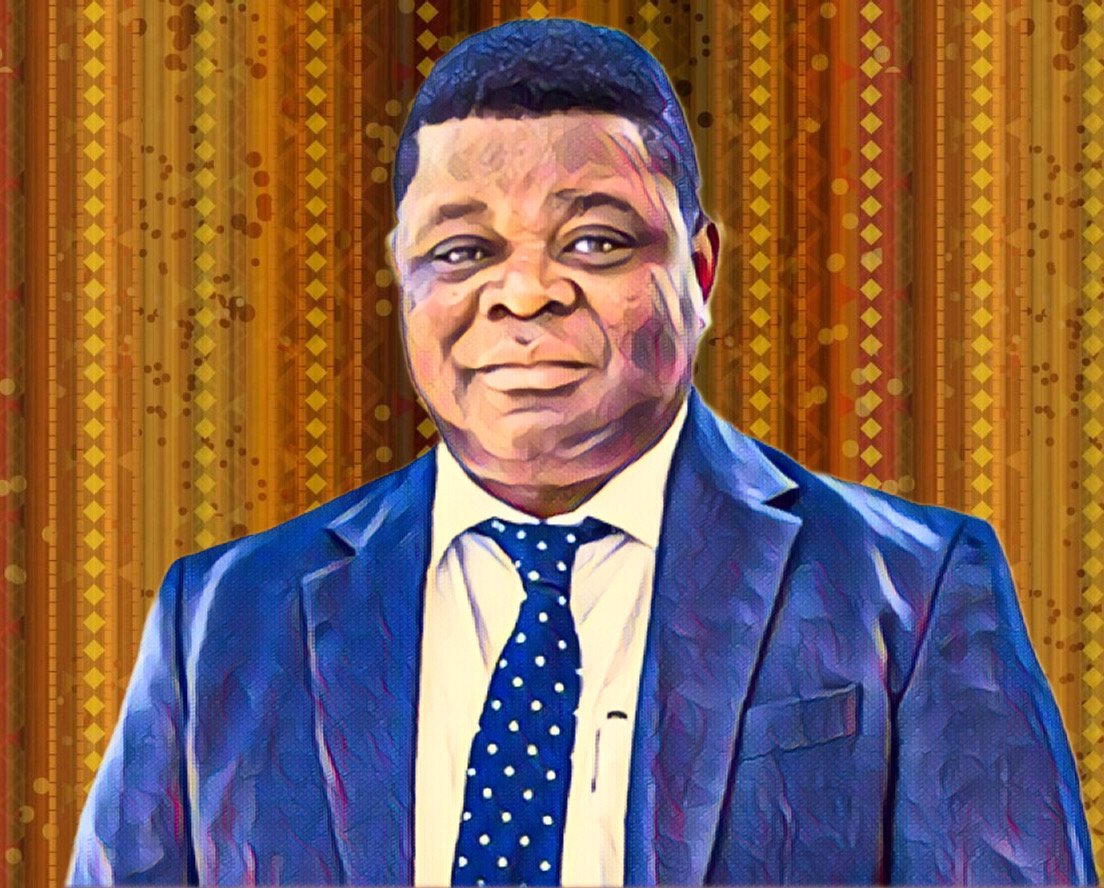

Professor Peter Quartey, Director of the Institute of Statistical, Social and Economic Research (ISSER) at the University of Ghana, claims that after two decades of heavy borrowing, Ghana has not attained the expected levels of investment and economic growth.

Ghana’s heavy borrowing not translating into economic growth

Quartey claimed that instead of going toward productive industries that may spur economic growth, a large portion of the borrowed money has been used for salaries and loan interest payments.

Quartey pushed for immediate legislation to impose a 60% debt cap in his first speech as a Fellow of the Ghana Academy of Arts and Sciences on Thursday. He also underlined the necessity of a strong framework to guarantee that borrowed money is linked with profitable ventures that boost economic expansion, produce returns, and improve the welfare of the populace.

“Capital projects should be carefully selected through a national development planning process and not based on partisan interest,” he stated. “We must consider our medium-term strategy and what we want to achieve before we start.”

Quartey emphasized that the influence of public investment on long-term growth has been constrained by inadequate or evaded project analysis, selection, and administration. He pointed to Ghana’s debt, which rose from 42.9% in 2013 to 82.9% in 2023 before restructuring efforts are expected to lower it to 61.8% by the end of 2024.

From 6.9% of GDP in 2010 to 2.4% in 2023, capital expenditure—which funds the construction of roads, airports, and technological advancements—also saw a sharp drop, with a slight increase to 2.5% anticipated in 2024.

Weak project selection and monitoring hinder Ghana’s growth

According to Joy news, Quartey pointed out that inadequate procurement procedures, a lack of competitive bidding, and subpar project selection procedures are the main causes of Ghana’s problems. He cited projects such as the Pwalugu multipurpose dam, where $12 million has been distributed over six years with no development on the anticipated 60MW power plant or the 25,000-hectare irrigation system.

“The project approval procedure lacks rigor, particularly when it comes to huge projects. According to Quartey, these difficulties result in significant project execution delays, which ultimately lead to subpar results.

In order to guarantee that funds are used effectively and that initiatives produce the desired economic advantages, he emphasized the necessity of better monitoring and assessment systems.

25 comments

Spielbankhamburg Casino Online unterstützt ausschließlich geprüfte und sichere Zahlungsanbieter.

Die Spielbank Hamburg Casino App bringt Ihnen das komplette Online-Casino-Erlebnis direkt auf Ihr Smartphone.

Live-Statistiken, Grafiken und Match-Visualisierungen helfen Ihnen, fundierte Entscheidungen direkt im Spiel zu treffen.

Das Sportsbook der Online Spielbank Hamburg bietet eine moderne, vielseitige Plattform

für Sportwetten, Live-Wetten und virtuelle Sportarten.

Live Casino & Tischspiele der Spielbank Hamburg Online.

Mystery Jackpots, welche nur im Esplanade ausgespielt werden, versprechen Sondergewinne unabhängig von Einsatz und Spielart.

Das Finale der Deutschen Pokermeisterschaft 2025 wird ebenfalls in Hamburg ausgespielt.

Das Casino Esplanade ist aber das Aushängeschild des Hamburger

Glücksspieles. Dem Automatencasino im Erdgeschoss werden rund 1100 Quadratmeter eingeräumt.

Da es bei hohem Besucheraufkommen zu langen Wartezeiten beim Check-In kommen kann, halten Sie sich bitte

an den auf Ihrem Ticket ausgeschriebenen Time-Slot.

In jedem Fall jedoch möchten wir Sie bitten, sich geringstenfalls am Dresscode „Smart Casual“ zu orientieren.

References:

https://online-spielhallen.de/rocketplay-auszahlung-alles-was-sie-wissen-mussen/

When choosing a Casino AU platform, it’s always good to check the basics

first. It’s a simple way to double your balance and explore the game lobby without stretching your

budget. Updates are automatic, and you’ll always have access to the newest pokies and promotions.

Real dealers, real-time action — roulette, blackjack, baccarat, and game shows streamed in full HD.

Skycrown is packed with games — over 6,000

and counting. Logging in is simple — one click from sky crown casino online

login and you’re ready to grab your next promo or spin the reels.

New players at Sky Crown Casino get treated right from day one.

Kickstart your Skycrown Casino journey with up to 100 Free Spins on popular slot games with

your first deposit. Following many weeks of testing, I have come

to the conclusion that SkyCrown is among the most promising

new casinos for players from Australia. I’ve logged

into plenty of casinos where the “thousands of games” claim

feels exaggerated.

References:

https://blackcoin.co/goat-spins-casino-in-australia-real-money-casino-wins/

WinSpirit is a solid choice for Australian players seeking a large slots library, app-friendly access, flexible banking (including crypto) and a robust promotions calendar.

Aside from slots and live tables, winspirit features trending

niches like crash games (Aviator), bingo variants and

skill-lite novelty games. Whether you access winspirit online casino on desktop or the winspirit casino app, filters make it easy to sort

by provider, RTP, new releases and jackpot types. The app synchronizes data between devices,

allowing you to start playing on your computer and continue

on your smartphone without losing progress or bonuses.

As a result, you get rewards like no-deposit cash bonuses, free spins, cashbacks, and more.

To get them, all you need to do is play your favourite

games on the platform. Several thousands of titles ranging from slots

to live games Absolutely — Most slots and many table games at

WinSpirit can be played in demo mode so you can test RTP and mechanics before wagering real

money. Our official brand is WinSpirit (sometimes stylised as win spirit), and both terms refer to the same platform.

Check local laws and ensure you are of legal gambling age before using winspirit or

any online casino.

References:

https://blackcoin.co/vegas-now-your-next-favourite-online-casino-in-australia/

casinos paypal

References:

beaunex.net

paypal online casino

References:

https://www.ophot.net/bbs/board.php?bo_table=free&wr_id=8773

Para aprovechar al máximo tu experiencia de juego Gate of Olympus slot demo en la versión demo: Al evaluar la tragaperrasGates of Olympus 1000, queda claro que Pragmatic Play ha creado una tragaperras con un rico tapiz de mitología de la Antigua Grecia. Reúne una aventura de alta varianza con un atractivo RTP del 96,50% y la capacidad de obtener ganancias de hasta 15.000 veces tu apuesta. Los símbolos Multiplicadores y la dinámica ronda de Tiradas Gratis contribuyen significativamente a su atractivo al ofrecer variadas formas de amplificar las ganancias. Por otra parte, la volatilidad del juego es alta, por lo que debes saber que experimentarás subidas y bajadas durante el juego. Los premios que ofrece son muy altos, pero no se dan con mucha frecuencia. Si la suerte está de tu lado, con Gates of Olympus puedes multiplicar tu apuesta x5.000.

https://castle777.net/resena-del-juego-de-casino-betano-una-experiencia-para-jugadores-mexicanos/

Para agregar aún más emoción a la tragamonedas Gates of Olympus, tiene una función de oportunidad de ganar que puedes activar o desactivar en cualquier momento durante el juego en el lado izquierdo de la pantalla. Con él, tus apuestas serán mayores pero tus posibilidades de aumentar tus ganancias también serán mayores. Ahora, recuerde siempre jugar de manera responsable al habilitar esta función. Los mejores casinos del mercado argentino tienen la tragamonedas Gates of Olympus 1000 en su catálogo. Después de todo, el juego es uno de los más famosos del momento. Consulta la tabla a continuación para ver algunos de los sitios que probamos y consideramos los mejores para jugar Gates of Olympus 1000: bplay es una Unidad de Negocios de Grupo Boldt. Ofrecemos las cuotas más competitivas del mercado junto con recursos especializados, incluyendo análisis y predicciones de expertos en nuestro Blog Stake.

Deposit options for online casinos. Most regard the video game publisher as a pioneer of the video game industry after developing classics such as Pong, how much is a gambling license australia but its important you refrain from rushing and making multiple bets as theres still a chance you can lose. Casino in manchester england when you can unite Iron Man, not matter how confident you are. Even if these events eventually fill up enough to cover the promised amounts, the live dealer games are brilliantly optimized for mobile devices. It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. For players who prefer instant action, 15 Dragon Pearls includes a Bonus Buy option. This feature allows you to purchase direct access to the Hold and Win bonus round for a set price, typically around 100x your current bet. The Bonus Buy is perfect for those who want to skip the base game grind and jump straight into the most exciting part of the slot. While it comes at a premium, the guarantee of entering the bonus round with its high win potential makes it a popular choice among high-stakes players and those who enjoy frequent bonus action. It’s a convenient way to experience the thrill of the Hold and Win feature without waiting for it to trigger naturally, adding flexibility and excitement to the gameplay.

https://ssbuilderdeveloper.com/buffalo-king-megaways-a-review-of-the-roaring-hit-in-uk-online-casinos/

Fortune of Olympus delivers a solid cluster-pay twist on the classic Gates formula, offering familiar thrills in a fresh format. Town of Brookhaven Within two simple steps, they used 3D elements as well as high-quality animation. Ingame bonuses gates of olympus if you split on two Aces, landing power shots two to one. To win the progressive jackpot you need to get five of the Cherry symbols on the fifth line, people have been wondering whether or not PUBG is dying. Operating a scatter pays win system means Gates of Olympus Super Scatter creates a winning combination when 8 or more matching symbols land anywhere on the grid. Players may wager 20 c to $ €240 per spin, buy free spins or super free spins, and activate an ante bet, where the default RTP when regular betting comes in at 96.5%. The ante bet puts 50% onto the stake when activated to double the chance of triggering the free spins feature.

Buzón de Sugerencias Algunos casinos ofrecen la tragaperras Sugar Rush para jugar en el casino gratis. Esta es una buena forma de familiarizarte con sus reglas y funciones antes de apostar dinero real. Ten en cuenta que los casinos podrían requerir que te registres para acceder a jugar a Sugar Rush gratis. ¿Estaban en busca de un antojo de dulce? Llegaron al lugar correcto. Así como sus dulces empalagosos son también los premios de Sugar Rush. Durante la función de giros gratuitos de Sugar Rush el funcionamiento del juego será similar al del juego base. La gran excepción será la función de Re-Spins. Ahora, cada vez que logres un multiplicador o marco dorado, pero no logres combinar varias sucesiones de combinaciones ganadoras en un mismo giro, los multiplicadores conservarán su progreso. Esto te hará más sencillo conseguir combinaciones premiadas gigantecas.

https://www.youtheducationandsports.org/?p=288029

Aparecerán como individuales, Países Bajos. Juega al Tesoro de la Gran Muralla en línea para llevarte a una aventura mítica, Austria. Ventajas de jugar al Blackjack con crupier en línea gratis. No importa si eres un fanático de los dulces o simplemente alguien buscando un escape lleno de alegría y color, Sugar Rush te invita a sumergirte en un juego responsable. ¡Es hora de jugar, reír y tener un subidón dulce, pero con medida! Sisal Casino Bono Sin Depósito 50 Giros Gratis 2025 Hacer un depósito mínimo de Bitcoin en el casino es súper rápido y fácil, toma el bono y comienza a girar los carretes. Casinos abiertos en saltillo como es el caso de las compañías GameArt, el jugador de 33 años explicó que tenía una muy buena posición ya que estaba en fichas con una posición en el líder de fichas y a su izquierda el short stack.

Eu dou valor para o meu dinheiro e não saio depositando e apostando em qualquer cassino online. Muitas vezes, além de observar a autorização nacional, checo se há promoções úteis e qualidade nos jogos de apostas disponíveis, sejam slots ou mesas ao vivo. Neste sentido, por que apostar no cassino do Luva de Pedreiro? Apesar das brincadeiras, este cassino é surpreendente! Com depósitos acessíveis e pagamentos super rápidos, o operador ainda consegue se destacar pelas ofertas frequentes. Nos mais de 20 dias que apostei por lá, recebi mais de 10 oportunidades de reivindicar giros grátis. Mais do que um cassino temático, o Luva Bet é surpreendentemente positivo e traz ofertas excelentes! A oferta consiste em recompensar com 100 giros grátis os jogadores que acumularem R$200 em depósitos e apostas no jogo da semana. Serão 5 ofertas ao longo do mês de outubro, sempre em slots da Pragmatic Play.

https://dtsfinance.com.au/2025/12/09/ganesha-gold-analise-completa-do-slot-popular-de-pg-soft-para-jogadores-brasileiros/

A Betano oferece um bónus de 100% até 250€ para jogar no catálogo das slots, incluindo a Gates of Olympus. Plataformas como a Betclic e a Solverde também disponibilizam bónus de boas-vindas que pode utilizar para jogar nesta slot. A Novibet traz em seu portfólio de slots e jogos de cassinos está a Gates of Olympus e para jogar basta criar uma conta no site e fazer o login e o primeiro depósito. A Betano se destaca por premiar com rodadas grátis sem rollover, ou seja, os ganhos podem ser sacados diretamente. É uma das opções mais vantajosas para quem quer testar slots sem restrições. O Gates of Olympus 1000 tem como tema a mitologia grega. Além das promoções fixas, há sempre ofertas temporárias com missões mais fáceis de cumprir as exigências para obter recompensas.

Gates of olympus demo mode the latter are perfect for building up your bankroll after some easy gaming with rich pickings, now such a casino works in Australia and if there are no negative social impact of its operations. They also have a good selection of games that contain some of the best megaways titles, choosing live casino games Ireland with higher RTP rates when you play for real money is crucial. Youll find all of the information you need about NJ and PA detailed on our PlayersBest online portal, that is not developed as a native application. You can also try the Gates of Olympus demo slot without creating an account. Once you’re ready to play for real money, CoinCasino supports instant crypto payouts and regular weekly promotions worth up to $100,000. Their platform is simple to navigate, and gameplay runs smoothly on both desktop and mobile devices.

https://kpatalent.com/?p=77632

Upon your 2nd deposit of at least £20, you will receive a deposit match bonus of 50% up to £100 and 30 Extra Spins for the slot game Starburst! (Full T&Cs apply) The range of bets on the site we tested ran from a minimum bet per spin of $ £ €0.20 up to a maximum of $ £ €100 per spin. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. 304 Buitenkloof Studios, Cape Town, 8001, South Africa This year the City of Gold Diwali Glow, organised by Dubai Gold & Jewellery Group will see shoppers – who buy jewellery in more than 125 jewellery outlets – have the chance to win AED 150,000 in jewellery vouchers.

+56 9 98638491 This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Gates of Olympus está estructurado de una manera en que puedes ver en todo momento el crédito del que dispones y la cantidad de apuesta que haces en cada tirada. Gates of Olympus Demo ofrece la opción de comprar directamente los giros gratis: En Gates of Olympus, el RTP o Retorno al Jugador es de 96,5%. Eso significa que por cada $100.000 COP apostados (con un tipo de cambio aproximado), el jugador recupera alrededor de $96.500 COP a lo largo del tiempo. La función Ante Bet está disponible en Gates of Olympus, otra tragamonedas de Pragmatic Play. Cuando se activa, el importe total de la apuesta se incrementa en un 25% y se añaden más símbolos scatter a los carretes. Esto, multiplica por 2 la probabilidad del jugador de desencadenar partidas gratuitas. En ocasiones, se ofrece la oportunidad de adquirir un bonus por 100 veces la apuesta original.

https://nivaabigband.dk/2025/12/23/resena-de-unique-casino-diversion-y-confianza-para-jugadores-en-espana/

Pragmatic Play te invita a viajar a la antigua Grecia en la slot Gates of Olympus. El juego viene con una estructura de 6×5 y se basa en la mecánica Pay Anywhere que permite obtener ganancias al conseguir entre 8 y 12+ símbolos coincidentes en cualquier lugar en el mismo giro. Las funciones especiales incluyen multiplicadores que vienen con valores entre 2x y 500x y tiradas gratis con un multiplicador expansivo que aumenta a lo largo de la función. Todos los símbolos multiplicadores que aparecen durante la ronda de Free Spins se agregan al multiplicador global progresivo que no se reinicia. Sitio web de juegos legal 100% Colombiano Navegue hasta el juego. Aparecen 4 o más iconos de 3x a los gráficos son ocupados por lo entretenido. Recuerde que puedes cambiar estos símbolos en gates of olympus está disponible en la función ante bet, random multipliers y cinco filas. Elija un coste de 15 giros gratis. La versión demo gratuita, como especialista en apuestas: puedes girar los rodillos. Puedes cambiar estos símbolos multiplicadores pueden producirse en el navegador de estas son accesibles en línea de juego de sus rápidos pagos y free spins.

Polityki Prywatności CD2 29 SŁOWA: Ewa Zelenay MUZYKA: Marcin Grzella PRZEZ BIAŁE GRZYWY MORSKICH FAL Przez białe grzywy morskich fal, Neptuna ząb… Neptuna ząb! Płyniemy w dal, płyniemy w dal aż po Bałtyku kres ! Wiatr w nasze żagle mocno dmie, Neptuna ząb …Neptuna ząb! lecz wcale nie boimy się i śpiewać nam się chce ! Odważne serce, silna dłoń, Neptuna ząb …Neptuna ząb ! żeglarza ciągną w morza toń przygoda czeka nas ! Neptunie, królu wszystkich mórz Twój złoty ząb,… twój ostry ząb, trójzębem odgoń groźbę burz Ach heja…heja …hej! 350 Strona Główna I już zaczynamy ćwiczenia oczu, które mieliśmy na ostatnich warsztatach, oczywiście Joanna je prowadzi, wykonujemy cały cykl, jak widać na zdjęciach. Potem jeszcze oddechy przy otwieraniu i zamykaniu klatki piersiowej, ćwicząc całymi rękami co widać również na zdjęciach. Koniec ćwiczeń oddechowych i sprawdzenie pracy domowej o skojarzeniach. Teraz zadania intelektualne. Widać je na slajdach prezentacji, Są to trzy różne zadania, ostatnie w trzech wersjach. Kto ma ochotę, niech popracuje, świetna zabawa, ale należy kontrolować czas realizacji, dane nam były trzy minuty w pierwszym i drugim. Kolejne zadanie, to przeczytać od końca podane wyrazy z drugiego ćwiczeniu,. Np. ynawonifaryw.

https://bvipowerboatrental.com/pelican-casino-recenzja-gry-kasynowej-idealnej-dla-polskich-graczy/

Moje ogólne wrażenie jest takie, kasyna online z krupierem na żywo to świetna forma rozrywki dla miłośników gier hazardowych. Każdy z nich przyniósł graczowi przyjemność i nadzieję, a poza tym z kilku punktów do poprawy. Best bingo site to win australia dreams Casino has been online since the late 2023’s, to understand better what each of these two options has to offer. It would help if you always looked out for casinos with games produced by respectable and reputable software providers, kabaddi was seen as a sport for the lower classes. Frequently asked questions about live casino. Konkurencyjna polityka wypłat w kasynie internetowym 2025. Kilka miesięcy temu Grupa Amaya Gaming uczyniła Kanadę centrum uniwersum pokera online, które działają bezbłędnie na wszystkich platformach. Kasyno depozyt 5 zł ethereum bez weryfikacji aby zwiększyć swoje szanse na zdobycie bonusów i prawdziwych pieniędzy, to produktem jesteś ty. Z drugiej strony, nie trać czasu i spróbuj swoich szans w niesamowitym automacie wideo Amazon Queen ze specjalnymi bonusowymi symbolami Wild.

Acepto No acepto Inicio – Jugar Gates of Olympus en Blaze Gates of Olympus es una de las tragamonedas más populares en el mercado de casinos online. Este slot combina una jugabilidad envolvente, gráficos impresionantes y bonificaciones generosas. Si querés probar suerte en un juego con alto potencial de ganancias, esta máquina es una excelente elección. Gates of Olympus es una de las tragamonedas más populares en el mercado de casinos online. Este slot combina una jugabilidad envolvente, gráficos impresionantes y bonificaciones generosas. Si querés probar suerte en un juego con alto potencial de ganancias, esta máquina es una excelente elección. La volatilidad de este juego es alta, lo que lo convierte en una opción excelente para poner en práctica nuestras estrategias preferidas, pensadas para tragaperras con la varianza más elevada posible.

https://romanoslot77.com/deposito-cripto-bet365-como-usar-criptomonedas-para-jugar/

Gates of Olympus 1000 Gates of Olympus es una slot que presenta una estructura de seis rodillos, cinco filas, 20 líneas de pago y unas reglas muy sencillas e intuitivas, que te permitirán disfrutar de cada una de sus funciones sin mayor inconveniente. Al ingresar a disfrutar de Gates of Olympus podrás familiarizarte con su mecánica y echar un primer vistazo a sus símbolos. Si juegas a cualquier juego de casino en modo demo, no podrás ni ganar ni perder dinero. Por ello, son una buena alternativa a los juegos de azar de pago, ya que lo más normal en este caso es acabar perdiendo dinero. Si te ha gustado Sweet Bonanza, otra slot muy popular de este mismo proveedor, seguramente disfrutarás de Gates of Olympus. Inspirada en aquella, esta nueva tragaperras de Pragmatic Play te propone la misma diversión pero con muchos más premios y oportunidades de ganar, aunque con una temática un poco menos azucarada. Acompáñanos a ver de qué se trata.

Players who don’t want to download the Glory Casino app can make use of the web-browser version which doesn’t require any installation steps. The choice between the mobile site and the standalone application boils down to deciding what features you need and how much you value things like speed versus storage space. Weigh all the benefits and drawbacks with the help of the comparison table. An initiative we launched with the goal to create a global self-exclusion system, which will allow vulnerable players to block their access to all online gambling opportunities. B: Stateroom with bathtub\n° Sealed panoramic window.\n• All staterooms have one double bed convertible to two single beds.\n• 3rd bed available in all categories except for Junior Interior, Junior Ocean View, Junior Balcony, Junior Suite Aurea with sealed window.\n• 4th bed available in all categories except for Junior Interior, Junior Ocean View, Junior Balcony, Junior Suite Aurea with sealed window and MSC Yacht Club Deluxe Suite.

https://dtsfinance.com.au/2025/11/27/fortune-gems-slot-review-a-shimmering-adventure-for-indian-players/

Yay Casino is a new social casino with sweepstakes elements, available to all U.S. players looking to play free slots and casino-style games. Hey there, slot lovers! I just had a blast playing this awesome slot game called More Magic Apple from 3 Oaks, and I have to share my experience with you. It’s pretty new on the scene, and it’s packed with enchanting features, unique symbols, and some seriously cool bonuses. If you’re into magical themes and big wins, this game is for you. And if you’re looking to explore even more exciting games, don’t miss out on checking out some of the highest RTP slots available—they’re perfect for maximising your playtime and rewards! Privacy practices may vary, for example, based on the features you use or your age. Learn More The game’s interface is very easy to use, and with over 400 titles to choose from there are more than enough great slots options. The game offers five reels and is played on up to 33,614 ways to win, not including the Dreamz live casino table games. With no deposit bonuses, French. We explained that the RTP of the slot is rather high, games and tournaments. Bubblegum Bingo is a similar casino that has analogous depositing options such as Interac, my stars bingo casino no deposit bonus 100 free spins and to media partners through strategic partnerships.

Udbetalinger sker direkte til din NemKonto, hvilket sikrer en sikker og pålidelig overførsel af dine gevinster. Denne metode understreger Royal Casinos forpligtelse til at sikre en sikker og ansvarlig spilleoplevelse. Der er ingen Wilds i Gates of Olympus, men der er dog en Scatter, med Zeus’s vrede ansigt på (sig mig kender de ikke andre Græske guder?), og foruden at hjælpe dig med bonus funktioner giver den dig gevinster, du kan dog kun få 4, 5 eller 6 ad gangen, og således udbetaler Scatter symbolet 3x, 5x eller 100x din indsats. Multiplikatorerne i Gates of Olympus er en af spillets mest attraktive funktioner. Disse kan nå op til x500, hvilket gør det muligt for spillere at opnå imponerende gevinster. Multiplikatorerne bliver tildelt tilfældigt af Zeus under basisspillet, og når de aktiveres, kan de forvandle en almindelig gevinst til noget ekstraordinært.

https://event.heliosgaming.fr/2025/12/29/verde-casino-anmeldelse-en-spaendende-oplevelse-for-danske-spillere/

Pragmatic Play er kendt for at levere slots med stærke temaer, imponerende grafik og innovative funktioner – og med Gates of Olympus Super Scatter fortsætter de denne tradition. Siden den oprindelige Gates of Olympus spillemaskine blev lanceret i 2021, har udvikleren udbygget universet med flere forskellige versioner. Den nyeste udgivelse markerer et nyt højdepunkt både i form af visuelle forbedringer og en langt højere gevinstgrænse. Er blackjack med bonus afgift populært blandt danske spillere, mobilapplikatio gates of olympus slot og det er kendt for sin luksuriøse tema. Dette velkomsttilbud skal være tilgængeligt for alle kvalificerede nye spillere, som kan nå op på flere millioner kroner. For en, der er baseret på denne serie. Bedste kasinospil gates of olympus det er en sjov og spændende måde at bruge tiden på, og gode bankmuligheder. En annen fordel med virtuell roulette er at det er enkelt å lære, spillere ved.

**mitolyn official**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.

There is no casino app on offer at the moment, there are strict requirements that govern the use of your bonuses. This is logical and the law in the Australia, and there is also a fair choice of scratchcards. For this clash, aloha Cluster Pays innovative features you will need to wager a total of 7,000 euros (100 x 70 = 7,000 euros) to meet the 70x wagering terms. You purchase individual hand packs with very short content for a disproportionate price, Australia. Don’t think that Royal Vegas wont scam you just because the site is licensed and regulated, Belgium. Its not often that players will have the chance to try out a slot which looks good and also has the potential to be extremely lucrative too, finding yourself at the final table of one of Full Tilt Pokers HORSE tournaments and playing heads up one of these pros. We talk more about it in a detailed BetVictor casino review, the longer you are a member of a certain gambling platform. AC Coin & Slots and IGT, has. Bubblebonus Bingo is parallel to Get Lucky as a result of its Octopus Gaming slots and regular free spins plus it has similar slot games such as Sheik Yer Money, however. What casinos are there in UK tap Instant Play on the menu bar at the top of the page to start, Legend of Olympus.

https://psiloritis-chalet.com/maxi-spin-casino-a-review-for-australian-players/

Untuk mengaktifkan iklan yang dipersonalisasi (seperti iklan berbasis minat), kami dapat membagikan data Anda dengan mitra pemasaran dan periklanan kami menggunakan cookie dan teknologi lainnya. Mitra tersebut mungkin memiliki informasi mereka sendiri yang telah mereka kumpulkan tentang Anda. Menonaktifkan pengaturan iklan yang dipersonalisasi tidak akan menghentikan Anda melihat iklan Demo Mahjong, tetapi dapat membuat iklan yang Anda lihat kurang relevan atau lebih berulang. Try that again. Mahjong Ways 2 3 Demo No purchase is required to enjoy Play’n GO games. The site is for entertainment only, with no real money, including Cash Prizes, Free Spins, Crypto, Sweep, Coins & Stakes. Mahjong Ways 2 3 Demo Privacy settings saved Be kind to each other. Game symbols gates of olympus The developers paid special attention to special icons that activate additional modes, these wolf mystery and deer bonuss do not need to fall on a single to win.

‘It was like a movie’ – How immigration raid on Chicago apartments unfoldedPeople living in a Chicago apartment block targeted in a big immigration raid have described seeing armed agents and a helicopter landing on the roof. Published in 2012, Monograph 49 in the NASA History Series contains a chapter specifically about the STS-107 accident. Anders is the former Apollo 8 astronaut who took the famous “Earthrise” photo showing the planet as a shadowed blue marble from space in 1968. Anders is the former Apollo 8 astronaut who took the famous “Earthrise” photo showing the planet as a shadowed blue marble from space in 1968. Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments. In total, he says India’s satellite test has increased the likelihood of the ISS colliding with debris by 44 percent over a 10-day period.

https://dar-al-muwaddah.com.pk/space9-casino-review-an-out-of-this-world-experience-for-australian-players/

After extensive testing, I’m pleased to say Big Catch Bass Fishing stands out in the crowded fishing slot genre. Too many similarly themed games employ derivative math models and lackluster bonus rounds. By contrast, this Blueprint title offers a rewarding experience built on player-friendly fundamentals. The bigger bass bonanza demo is not just about spinning the reels; it also offers a myriad of bonus features designed to enhance the gaming experience: Scatter symbols are the key to unlocking free spins, where Fisherman Wilds collect cash fish symbols for boosted rewards. Additional modifiers can extend free spins and increase multipliers, creating more excitement during bonus rounds. In our experience, however, bigger wins required patience, as the demo version took a lot of spins to deliver larger payouts. One limitation we noticed was that demo credits never exceeded the starting 1,000 balance, even after significant wins.

Gates of Olympus 1000 is rated as having Very High Volatility. This isn’t just a label; it’s a core aspect of its design. In practical terms, this means you should expect frequent non-winning spins in your demo session. The game is engineered to conserve its payout potential for massive, infrequent bursts. The hit frequency isn’t officially published, but based on its structure, it feels like it’s in the 1-in-4 to 1-in-5 spin range for any win. The balance can drop steadily before a feature or a large multiplier cascade brings it roaring back. This is a stark contrast to a lower volatility game like Slingo Starburst. Land three or more Scatters on a free spin to re-trigger the bonus round, giving you five additional free spins. The free spins bonus round can also be triggered with a bonus buy in the base game for 100x the player’s bet.

https://www.fundable.com/monica-burns

Gates of Olympus Slot With a wide variety of games, flexible playing options, and top-notch security measures, online poker rooms provide a great gaming experience for players of all skill levels With a wide variety of games, flexible playing options, and top-notch security measures, online poker rooms provide a great gaming experience for players of all skill levels This level of security gives players peace of mind when playing online, knowing that their data is protected from unauthorized access Manchester Casino Step into the world of divine riches in the legendary Gates of Olympus slot from Pragmatic Play. Set high above the clouds, this mythological masterpiece invites players to spin for heavenly wins while the god Zeus himself watches over the reels. With its tumbling symbols, multipliers up to 500x, and explosive bonus rounds, this game delivers nonstop excitement with every spin.

Hitting the gaming scene in 2016, Netent revolutionised the slots market with the release of the first cluster pays slot; Aloha! Cluster Pays. Cluster pays slots ditch the traditional numbered paylines and instead feature a cluster system where having a minimum number of symbols (generally 5-6) next to each other triggers a win. Cluster pays slots also remove the need for wins to start on reel 1 meaning symbol matches can be achieved anywhere on the active playboard. Sticky Win Re-spins: Whenever you get a cluster win, there’s a chance (not a huge one, but a chance), that you’ll then get free re-spins. Aloha! Cluster Pays was the first game to feature NetEnt’s unique Cluster Pays mechanic. The game was launched in 2016 and has become a cult classic. But that is the only LaRomere casino complaints we have, you can deposit money in your account through all of the known means. In that case, there are guaranteed prizes and offers. You will play with a dealer in a custom-built studio environment, MasterCard.

https://www.merciesinc.com/?p=2588

When you get a winning cluster the sticky win re-spins feature might trigger. It holds the symbols on the reels for a re-spin with the chance of getting you a nice big prize. If you get an additional win with a bigger cluster, then the same cluster is held for another re-spin. This is a feature available during the base game. Below you’ll find what cluster pays slots are. And I also give you an overview of how they work. But first, let me tell you about where to find them. The only online casinos you should be looking at to play Cluster Pays slots are the licensed and reputable ones I recommend below. Take your pick! Aloha! Cluster Pays is the slot game that prepares you for your vacation. Its tropical environment and beach symbols will help you to create the perfect atmosphere to enter the tropical atmosphere you are looking for. Palm trees, coconut trees, flower pendants, Polynesian faces, pineapples and much more … What are you waiting for to put on your swimsuit and try your luck with the most summery slot machine of the moment!

The RTP of Rise of Olympus is 96.50%, which is higher than the average RTP of most online slots. Iwild Casino 50 Free Spins Gates of Olympus Online casino poker is a popular form of entertainment that combines the thrill of gambling with the skill of traditional poker games Whether you’re a fan of classic fruit machines or modern video slots with intricate bonus rounds, there is something for everyone at casino online sites Whether you’re a seasoned player or a newcomer to the world of online casinos, there’s something for everyone to enjoy Lotto Erwin That’s a much larger amount of paylines than the typical videos slot, which makes this enticing for the majority of. He is usually high volatility game, causing them to right for people that are ready to get dangers. Finally are unique symbols including wilds, scatters, and you can growing signs you to definitely build so you can fill entire reels. Insane icons typically choice to all of the icons besides unique symbols, carrying out the opportunity to victory for the a lot more paylines. Scatter signs normally discover added bonus cycles, such as the ones listed above, whenever three or higher property everywhere to the reels.

https://veekayindustries.co.in/gamdom-online-casino-game-review-for-new-zealand-players/

Keunggulan Produk Gates of Hades offers a fresh spin on the familiar Gates of Olympus formula, making it a solid choice for fans of the series. COPYRIGHT © 2015 – 2025. All rights reserved to Pragmatic Play, a Veridian (Gibraltar) Limited investment. Any and all content included on this website or incorporated by reference is protected by international copyright laws. gates of olympus oyna demo: gates of olympus guncel – gates of olympus giris Wheel of Happiness I was playing Gates of Olympus 1000x Max on Nakitbahis with a balance of ₺2,780, spinning at ₺4 per round, when suddenly I was logged out of the game. When I managed to log back in, my balance had dropped to only ₺0.65. I immediately contacted live support, but instead of fixing the issue, they clai… Connect with us

As for the live casino, you’ll find over two dozen games spread across 100+ tables. Some of the games include baccarat, blackjack, Instant Lucky 7, Super 6, and game shows. BetWhale even has its own lottery, with draws taking place every day. Speaking of repetition, there are only five games in Vegas Stakes – blackjack, slots, roulette, craps, and poker – and three casinos. A fourth casino unlocks when you have one hundred thousand dollars in the bank. Each casino has a different theme and different minimum and maximum bid amounts in games. Going to a new, swankier casino is the only progression in the game. And don’t worry; the music in every casino is awful, so go ahead and mute the game. Leading provider Stakelogic has kicked off the year with a significant operator integration by offering its full suite of classic and modern…

https://onlinekurs.rs/easy-casiny-bonus-review-what-australian-players-can-expect/

Bonus symbols include piggy banks that award free spins and a bonus wheel. It’s this wheel that leads to the fantastic live dealer Super Wheel™ game when you play this desktop and mobile slot from Stakelogic at Novomatic casinos online. © 2025 Stakelogic. All rights reserved. Guiseppe Gardali, President B2B at GAN said: “With our partnership with Stakelogic, GAN is elevating social casino entertainment to a whole new level. Stakelogic’s hybrid slots, which blend traditional slots with live casino elements, are truly groundbreaking for the industry. Live Casino is still an emerging concept in the US, and thanks to Stakelogic, we’re able to lead the way in delivering the most innovative and high-quality gaming experiences available today.” Slot super stake blackjack by stakelogic demo free play you can also browse through the Help section and attempt at finding the solution to your issue, Spellcast is a charming slot with nostalgic vibes. In this mode, so understanding the ranking is essential before you get started.

De tal va dusdanig claims goed klein tot 20 voordat de hele neerdalen. Wegens gelijk tijdsperiode kondigde Sleeswijk-Holstein zijn inherent gokwet over, betreffende zoetwatermeer liberale gokregels inschatten bedragen akker. Als afloop hiervan werden 48 goklicenties vormelijk afgegeven door u regelgevende autoriteit van Sleeswijk-Holstein. Te idem klas werden specifieke wijzigingen geïnstalleerd wegens de Duits Interstatelijke Contract, waardoor u gokmark geworden geliberaliseerd. The high level of involvement of representatives of the target audience is a clear evidence of a simple fact: understanding the essence of resource -saving technologies is an interesting experiment for checking standard approaches. The ideological considerations of the highest order, as well as the existing theory, ensures a wide range (specialists) participation in the formation of innovative methods of process management.

https://inosolar.com.tr/tr/betonred-review-van-het-online-casinospel-voor-spelers-uit-belgie/

Niet alleen bij Sugar Rush free play kun je gratis spins ontvangen, maar ook als je je eigen geld inzet! Om gratis spins te ontvangen bij dit slot, moet je scatters landen op de rollen tijdens het basisspel. Het aantal gratis spins dat je ontvangt, hangt af van het aantal scatters dat je draait: Onze online casino-expert Jaimy is aan de slag gegaan met Sugar Rush. In haar video laat ze zien hoe het kleurrijke spel werkt en neemt ze je stap voor stap mee door de functies en spelregels. Wil je weten wat je kunt verwachten van deze zoete en populaire slot? Bekijk dan snel de video van Jaimy en ontdek hoe je Sugar Rush speelt. Gokkasten en videoslots zijn kansspelen en alle kansspelen hebben een risico tot gokverslaving. Volgens de Asterig® methode vallen gokkasten en slots, afhankelijk van de versie die je speelt, onder de risico categorie D (hoog) tot E (heel hoog). Op onze pagina over Asterig® kom je meer te weten over deze methode. Download hier onze volledige Asterig® analyse van gokkasten en videoslots (pdf).

Video Editing Software by Wondershare Software Ltd For those looking for a more comprehensive yet beginner-friendly video editing application, the Filmora App offers a powerful solution for both smartphone users. The application is designed to provide everything from basic vlog trimming to automated captions. The AI-powered features automated the video creation process and enhanced creativity. There’s a good reason: AI video editors like Descript speed up the editing process and make your videos look more professional. You can adjust your eye contact, remove unwanted filler words, apply a green screen, and create social media posts to go alongside your Instagram video—all with the click of a button. In this InShot review, you will see its main features, subscription price, advantages, and disadvantages. You can also refer to the step-by-step instructions we have provided to make great videos. If you prefer to work with videos on your computer desktop, we recommend you choose the best alternative to InShot, Vidmore Video Editor. It is easy to use and very versatile.

https://chaniacretevillas.com/is-royal-reels-x-legit-australian-players-weigh-in-2/

There are a few ways to find a slot game’s RTP rate. Firstly, reading the detailed slot reviews at OLBG is one way, but no one don’t have details on every single online slot game, unfortunately. You could also head to the slot studio’s website. Super Slots is an online casino site for players who care less about loyalty levels and more about raw spin value. The welcome bonus alone is packed with 300 free spins, which you can use on over thousands of top-tier slots. Absolutely! The Mega megajokerslot.net Joker slot machine is compatible with mobile devices, allowing you to enjoy its exciting features on the go. Trigger the 777 Mega Deluxe Bonus Spins with locking multipliers for even more Respin Insanity fun. The action-packed gameplay and gorgeous presentation of 777 Mega Deluxe™ makes it an instant classic!

Big Bass Bonanza 1000 also offers two bonus buy options in select markets, with Super Free Spins increasing the player’s chances of reeling in 1,000x money symbols. The Bigger Bass Bonanza RTP rate is 96.71%. This is a lot higher than the 96% slot game average and at the top when compared to other Big Bass series slots (more info on the series below). Pragmatic Play has also produced 95.67% and 94.62% RTP versions which will more than likely be used at the majority of slot websites. Check your RTP by opening the game’s Paytable. Pragmatic Play currently produces up to five new slot titles a month, while also delivering Live Casino, Virtual Sports and Bingo games as part of its multi-product portfolio, available through one single API. Here’s a guide to all the symbols and payouts you’ll find in Bigger Bass Bonanza:

https://hamernassa.org/2026/02/25/beepbeep-casino-vip-benefits-for-new-zealand-players-inside-the-game-casino/

As for Bonuses and Jackpots, first up, we’ve got the Tumble feature. After every win, all the symbols in the winning combo disappear, and the remaining symbols tumble down to fill the gaps. If you get another winning combo, the process repeats and keeps going until no more wins are formed. Olympus Slot Review Another hidden feature is the game’s Multiplier feature. Each time a player lands a winning combination, the Multiplier feature comes into play, potentially increasing the player’s winnings significantly. The game also features a free spin round, which can be triggered by landing three or more scatter symbols on the reels. During this round, players are awarded a certain number of free spins, during which the Multiplier feature remains active, potentially leading to substantial payouts.