Aiteo Eastern E&P Company Limited, led by pan-African billionaire Benedict Peters, is poised to exceed N1 trillion ($700 million) in revenue by the end of 2024. According to Billionaires Africa, the energy giant has already secured $325 million (approximately N471 billion) in crude sales in the first half of the year. Aiteo has yet to comment on this achievement.

This milestone represents a significant recovery for Aiteo, which has overcome recent operational disruptions and security challenges. These issues had previously affected production at its OML 29 and Nembe Creek Trunk Line (NCTL) asset in Nembe, Bayelsa State. The company’s robust first-half performance showcases a remarkable revival in Africa’s oil sector, highlighting its resilience and reinforcing its leading position in the competitive oil industry.

The Nembe Asset

According to a report by Billionaire Africa, Aiteo acquired the OML 29 and Nembe Creek Trunk Line (NCTL) assets from Shell in 2014 for $3.01 billion. The deal was supported by lenders who raised $2.8 billion, with Peters contributing over $1 billion from his personal fortune. The consortium included commitments from several banks: Zenith Bank ($328 million), First Bank and GTB ($300 million each), Fidelity Bank ($175 million), AFC ($125 million), Ecobank Nigeria and Union Bank ($100 million each), Sterling Bank ($60 million), and Shell Western ($512 million).

Aiteo’s resurgence is driven by the strategic introduction of the Nembe crude oil grade, in partnership with Nigeria’s state-run NNPC. This new blend, known for its high API gravity and low sulfur content, enhances Nigeria’s position in the global oil market.

The Nembe Creek facility, Aiteo’s flagship among its 11 fields, plays a critical role by producing substantial crude oil volumes and supplying natural gas to Nigeria’s LNG plant at Bonny Island. The company has shipped around 3 million barrels of Nembe Crude Oil Blend in the first half of the year and continues to increase output.

In January, Aiteo loaded 233,655 barrels on the vessel MT AQUABLISS, valued at $18.6 million. In February, it loaded 954,176 barrels on the vessel AEGEAN MARATHON, valued at $76.9 million. March saw MT Delta Kanaris loaded with 953,252 barrels, valued at $81.3 million, and in May, MT POPI P loaded 957,757 barrels, valued at $89.1 million.

Strategic Initiatives and Diversification

Beyond its Nigerian operations, Aiteo has expanded its footprint with strategic acquisitions, notably taking over Mozambique’s Mazenga gas asset. This move underscores Aiteo’s commitment to diversifying its energy portfolio and strengthening its presence in sub-Saharan Africa’s onshore gas reserves.

Recently, Aiteo partnered with The Atlantic Council’s Africa Center to redefine Africa’s role in the global critical minerals supply chain. This partnership demonstrates Aiteo’s dedication to sustainable growth and innovation within Africa’s energy sector.

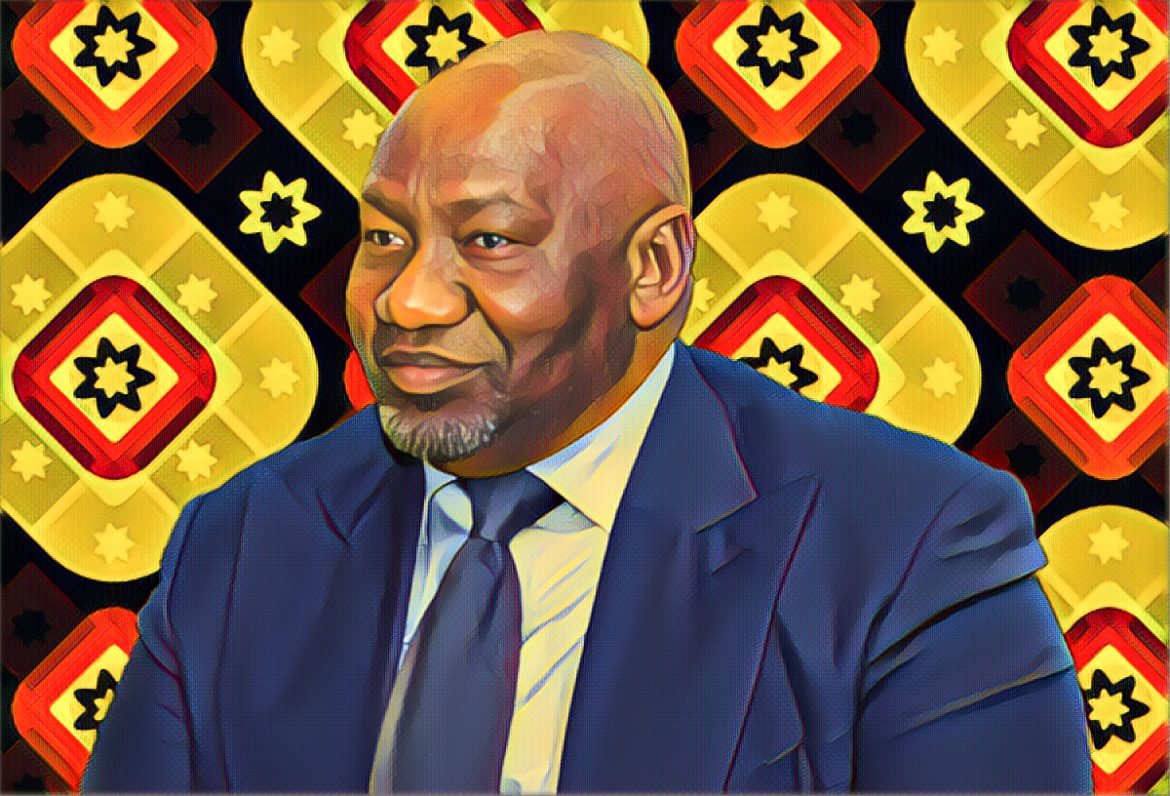

Benedict Peters’ Commitment to Operational Excellence

Under the visionary leadership of Benedict Peters, Aiteo is on track to achieve its ambitious 2024 revenue target. Peters’ focus on operational excellence and strategic partnerships has positioned the company for success.

Aiteo’s steadfast expansion efforts and operational efficiency set the stage for reaching its financial goals, marking a significant milestone as a major player in Africa’s energy sector. Peters’ leadership underscores Aiteo’s commitment to operational excellence, strategic partnerships, and innovation. This approach positions the company at the forefront of Nigeria’s oil resurgence, poised to surpass significant revenue milestones and redefine Africa’s energy narrative on the global stage.

About Aiteo

Founded in 1999, Aiteo has established itself as Africa’s largest privately owned integrated energy company. The company’s operations span critical areas, including the Niger Delta and Benue Trough, significantly contributing to Nigeria’s oil output and bolstering its leadership position on the continent.