Development Bank Ghana (DBG) is set to channel GH¢1 billion into the nation’s economy this year by providing funds to commercial banks and other financial institutions for on-lending to pivotal sectors. This initiative aims to bolster long-term economic growth across various key areas, including agriculture, manufacturing, ICT, and high-value services.

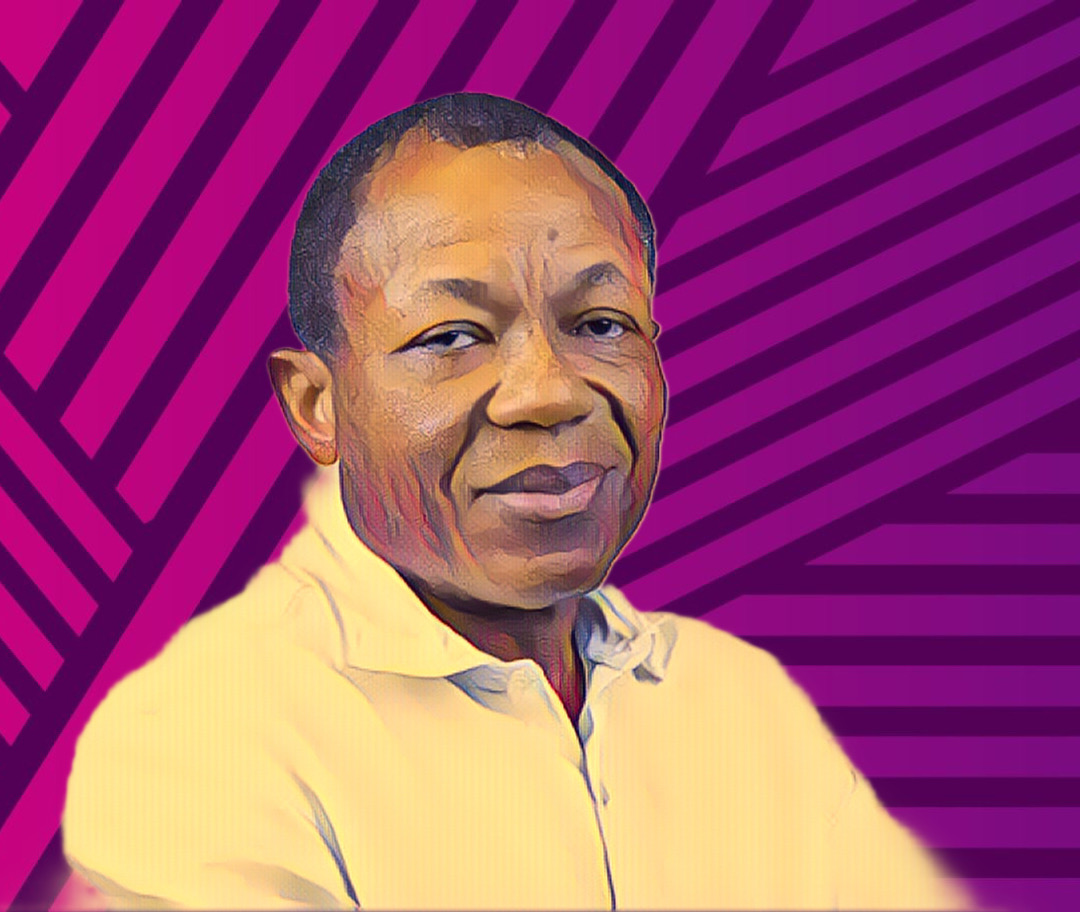

Kwamina Duker, the Chief Executive of DBG, shared this ambitious plan during an interview with JOY BUSINESS in Washington DC, where he was attending the Annual IMF/World Bank Spring meetings. “Since we started operations, we have advanced $1.0 billion through our participating financial institutions to the private sector, and we intend to increase to $2.0 billion before the end of this year,” Duker stated, highlighting the bank’s commitment to expanding its impact on Ghana’s economy.

The DBG, which was established in 2020 and launched full operations in 2022, has quickly become a pivotal player in the financial landscape, focusing on areas that traditionally lacked sufficient financial support. The bank is jointly financed by the Ghanaian government and international partners including the Federal Ministry for Economic Cooperation and Development of Germany through KfW, the World Bank, the African Development Bank, and the European Investment Bank.

Support for the Agricultural Sector

One of the significant announcements made by Duker was the targeted allocation of funds to boost the agricultural sector. Out of the GH¢1 billion earmarked for disbursement in 2024, 25% to 35% is designated specifically for agriculture. This focus is part of a broader strategy to transform Ghana’s economy through enhanced food security and agricultural productivity.

Duker explained, “Our focus is primarily on agriculture, and that is why we are working with the Ghana Incentive-Based Risk Sharing System for Agricultural Lending (GIRSAL) to help deal with funding challenges in the sector.” This collaboration is expected to address some of the persistent barriers to financing in agriculture, enabling more sustainable and effective support for farmers and agricultural businesses.

Impact Financing

In addition to providing funds, DBG is committed to ensuring that these investments achieve tangible impacts. The institution has implemented robust measures to ensure that funds are directed to the right sectors and that they contribute to substantial economic and social benefits. “We are not lending for lending’s sake but rather lending with purpose and targeting bankable deals,” Duker emphasized, underscoring the strategic approach taken by DBG to financial support.

This methodical strategy aligns with DBG’s broader objectives to fuel prosperity and unlock the potential of Ghana’s economy by providing financial support and expertise through participating financial institutions. By focusing on sectors that are crucial for development but have historically been underserved, DBG aims to catalyze significant economic transformations.

8 comments

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Statt eine App zu installieren, kannst du bei allen lizenzierten Casinos auch einfach im mobilen Browser spielen. In deutschen Online Casinos sind insbesondere Spielautomaten wie Book of Ra und Eye of Horus sowie klassische Tischspiele wie Blackjack und Roulette sehr beliebt.

Der Willkommensbonus kann sowohl aus einem Einzahlungsbonus als auch aus Freispielen bestehen, um

neuen Spielern den Einstieg zu erleichtern. In deutschen Online Casinos werden verschiedene Spielekategorien angeboten, dazu gehören Spielautomaten, Tischspiele und Live Dealer Spiele.

Die breite Spieleauswahl umfasst alles von klassischen Slots bis hin zu modernen Video-Slots und Tischspielen.

Ja, deutsche Spieler können frei in Online Casinos spielen. Diese Casinos bieten einen deutschen Kundensupport und Sie können sicher sein, dass dieses eingespielte Teams Ihnen helfen wird.

Das heißt, wenn der Anbieter eine Lizenz der MGA besitzt, dürfen Sie als deutscher Spieler

von Deutschland aus in diesem Online Casino spielen.

Die Freispiele werden zum Beispiel im Zuge von neuen Spielvorstellungen oder über den Newsletter des Casinos an euch

verteilt. In den besten Casinos in Deutschland sind die Freispiele laut unseren Tests ein stetiger Begleiter.

Zusätzlich werden diese oftmals durch Freispiele oder andere Angebote aufgewertet.

References:

https://online-spielhallen.de/stake-casino-auszahlung-ihr-umfassender-leitfaden/

The online casino scene in Australia is booming, with trends shaping how players engage in 2025.

Many best online casinos like King Johnnie let you mix and

match. The top Australian online casino sites on this page

all passes these tests.Games with the highest RTP, such as blackjack, baccarat,

certain pokies, and some video poker variations, increase your chances of walking away

a winner. Expect tighter regulations but more

innovation in safe internet casinos AU.Yes, online casinos are regulated and must be licensed to serve Australians legally.

Fat Fruit Casino’s collaboration with Betsoft delivers 3D pokies, while PlayMojo Casino’s Evolution-powered live games keep players hooked.

Okay, this isn’t really news, but it still may be

news to someone. Online gambling is no longer just about spinning the reels or busting on blackjack.

With over 6,300 games from leading studios such as Pragmatic Play and BGaming, it easily keeps up with the best-in-class.

You’ll even find games that you didn’t necessarily expect to find, like Top

Card, Cash Crab, or The Kickoff. It boasts a massive 600+ game library of live dealer tables and game shows.

If you feel your gambling habits are getting out of

hand, you can sign up for self-exclusion. Some operators also let you set time limits to help you control how much time you

spend playing on the site. If you set a wager or loss limit,

you won’t be able to increase your bet or continue playing, respectively.

Fast withdrawals, especially via crypto and e-wallets, highlight

the casino’s focus on efficiency and player satisfaction. Regular promotions and a tiered

VIP program reward loyalty with cashback, bonuses, and exclusive perks.

New players benefit from a generous welcome package

of up to $2,000 plus 100 free spins.

Even if you’re having a bad run on the pokies, upping your bets in an attempt to recoup

what you’ve lost can end in disaster. Cashback is usually credited on a daily or weekly basis,

depending on the casino. It also delivers flexible

transaction limits compared to e-wallets and debit/credit card payments.

This mode of payment is fee-free, secure, and direct – it connects your

bank to your casino for uninterrupted transactions with no middleman required.

References:

https://blackcoin.co/best-live-casinos-in-australia-2025-guide/

paypal casino online

References:

the-good.kr

online casino paypal

References:

https://recruit.brainet.co.za/companies/us-online-casinos-that-accept-paypal-2025/

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

超人和露易斯第二季高清完整官方版,海外华人可免费观看最新热播剧集。