Ghana’s forthcoming digital currency, the digital Cedi, could emerge as the premier central bank digital currency (CBDC) worldwide, predicts fintech specialist Jason Marshall.

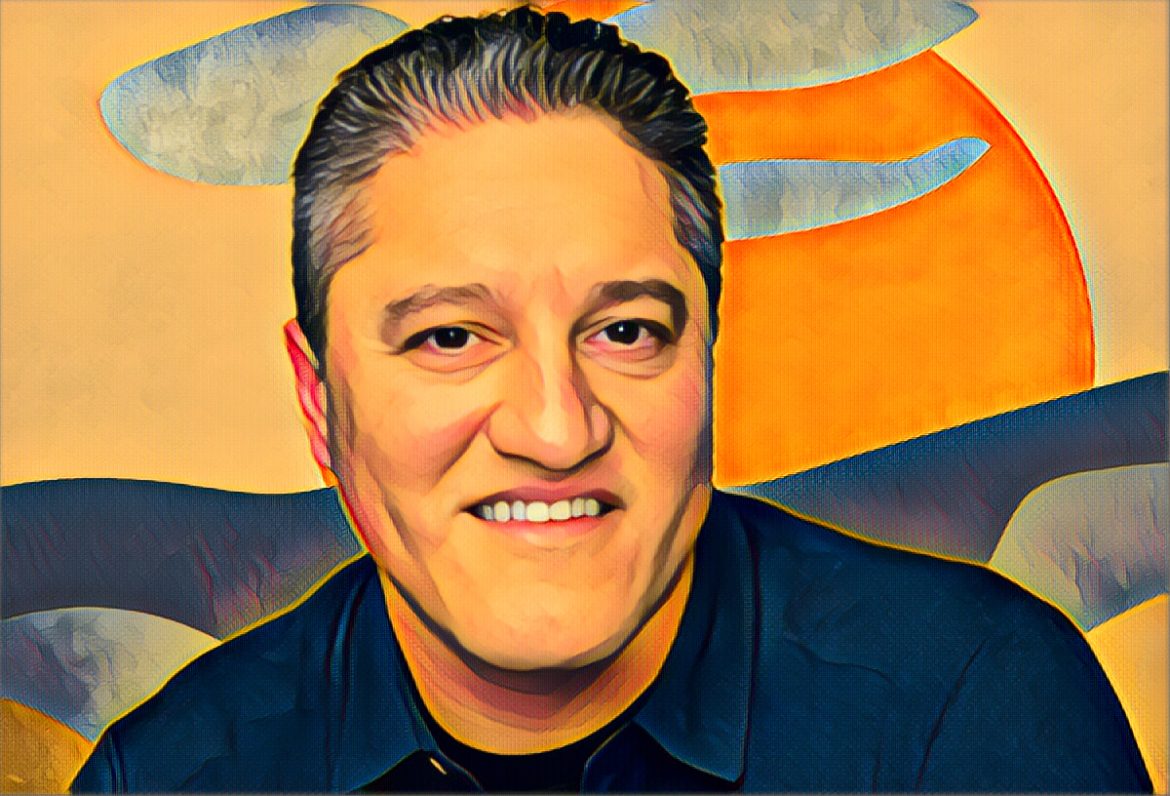

Marshall, who is the Chief Operations Officer (COO) of Yellow Card, a digital payment company, underscored the significance of the digital Cedi during an interview in Accra with the Daily Graphic. The digital currency, governed by the Bank of Ghana (BoG), aims to enhance financial inclusion, bolster the efficacy and reliability of the payment system, and stimulate competition within the nation’s financial sector.

According to a report by Graphic Online, Marshall lauded the Bank of Ghana for its strategic development of the digital Cedi platform, pointing out its unique blockchain-based foundation. “This isn’t just a bank-issued token. The digital Cedi is, in essence, cash,” he emphasised.

Drawing a distinction, Marshall highlighted that, unlike mobile money—which is essentially electronic money backed by tangible cash—the digital Cedi functions as money itself.

In this cryptocurrency-focused age, Marshall foresees the digital Cedi, serving Ghanaians keen on trading digital currencies securely. He envisions a future where one can seamlessly transfer money from the U.S. to Ghana instantly at no cost.

Complementing the digital currency initiative, the BoG, in collaboration with EMTECH Solutions Inc., plans to host an “eCedi Hackathon.” This 12-week innovation contest invites fintechs, developers, and innovators to formulate groundbreaking CBDC applications. Aiming to address Ghana’s financial inclusion issues, the event will culminate in a conference celebrating the most exceptional solutions with awards.

Like many fintech entities, Yellow Card plans to partake in this hackathon. “Although our knowledge about the initiative is nascent, our engineering team is diligently exploring the system, preparing for active involvement in the eCedi Hackathon contest,” Marshall noted.

5 comments

Dabei spielt die Qualität und der Umgang mit den Produkten für uns die Hauptrolle.

Auf Bildschirmgeräte können auch herkömmliche Kasinospiele wie Black Jack, Poker

und Roulette aufgespielt werden. Je nach Ausführung der Maschine

können auch mehrere Gewinnlinien, bis zu 25, oder Kredite je

Gewinnlinie gespielt werden.Der Einsatz pro Spiel kann dann weit über 200 Kredite (bei einem Kreditwert von 50

Cent somit 100 Euro) betragen.

Sie sehen gerade einen Platzhalterinhalt von Turnstile.

Bitte beachten Sie, dass dabei Daten mit Drittanbietern ausgetauscht werden. Sie müssen den Inhalt von reCAPTCHA laden, um das Formular abzuschicken. Fühlen Sie sich frei, uns

jederzeit anzurufen – oder senden Sie uns eine Anfrage.

Player können hier an den neuesten Terminals Slots wie Double Triple Chance, Book of Ra oder Torrero speilen. Die Innendesigner haben sich im Flagship der

Schnicks-Spielhallen-Gruppe etwas einfallen lassen, um die

Spielautomaten der außergewöhnlich in Szene zu setzen. Wer die

Schnicks Casino Lounge in der Kölner Johannisstraße besucht,

könnte meinen, dass er sich an Deck von Raumschiff Enterprice

befindet. Hierfür wurden eigens alle Spieltische zur Seite geräumt.

In der Bonner Republik fand in der Spielbank mehrfach der

Bundespresseball statt.

References:

https://online-spielhallen.de/starda-casino-aktionscode-ihr-schlussel-zu-exklusiven-vorteilen/

To learn more about how to request a withdrawal via your online casino account, click here.

Next, you’ll need to make a deposit; after all, you’ll need money to play with.

For example, many Ignition pokies offer bonus buys; these allow you to buy

into a bonus round instead of having to activate it organically.

That is because the main purpose of eCOGRA is to audit and revise everyday activities

performed by online casino operators and the software they use on the gambling platform.

The truth is that some online gambling games are banned, but the majority is allowed.

As long as you have a stable internet connection, you can enjoy

pokies, roulette, blackjack or any number of classic casino games from any location imaginable.

Professional and attractive dealers keep the game running, while you can also use

the live chat to communicate with other players.

Explore the world of betting sites and casinos in Australia right here and enhance your gambling experience today!

All you’ve gotta do is online casino bonus sign up and they might sling you some online casino free spins no deposit, for example.

Alright, let’s chat about getting your winnings ASAP

at online casinos. So, let’s have a look at the best payout methods at online casinos.

Let’s have a talk about something crucial in the online casino game

– how can you add money and grab those winnings.

VIP tables at live casinos often offer more personal dealer engagement, which many high-limit players enjoy.

Online live casinos in Australia have become hugely

popular because they blend the excitement of in-person gaming with the

convenience of online play. Understanding these rules

helps you choose safe and legal online casinos to play at.

Our goal at Casino Buddies is to help Australians find

top online casino sites that let you deposit and withdraw money in Australian dollars.

While this payment method is widely available in Australia, it cannot be

used for gambling-related activities at Aussie-friendly online casinos.

We find the best casino bonuses in Australia for new players, but if you’re

already playing, don’t worry—the best casinos will have special promotions for you too!

We advise you to read the terms and conditions of each

casino before using it. You need to know that deposit

methods and withdrawal are not always the same. But we got your back, so you won’t have to

go too far to find the casino of your dreams.

The rest of the game selection is decent. Neospin serves

up a 300% match bonus good for up to A$11,000 in bonus cash with 300 free spins.

It’s fast, it’s flexible, and it’s loaded with features that feel built for everyday visitors.

Others might switch it to USD or crypto when you deposit — it depends.

Some sites also run prize draws, or chuck in a promo occasionally.

References:

https://blackcoin.co/epicurean-the-ultimate-online-casino-experience/

online casino usa paypal

References:

dev.yayprint.com

online casinos that accept paypal

References:

https://ajira-hr.com/employer/best-real-money-online-pokies-in-australia-for-december-2025