KEY POINTS

-

People are carrying over $1 million out of Ghana undeclared.

-

Large cash leakages pose risks to economic stability.

-

Bank of Ghana is tightening oversight to fight abuse.

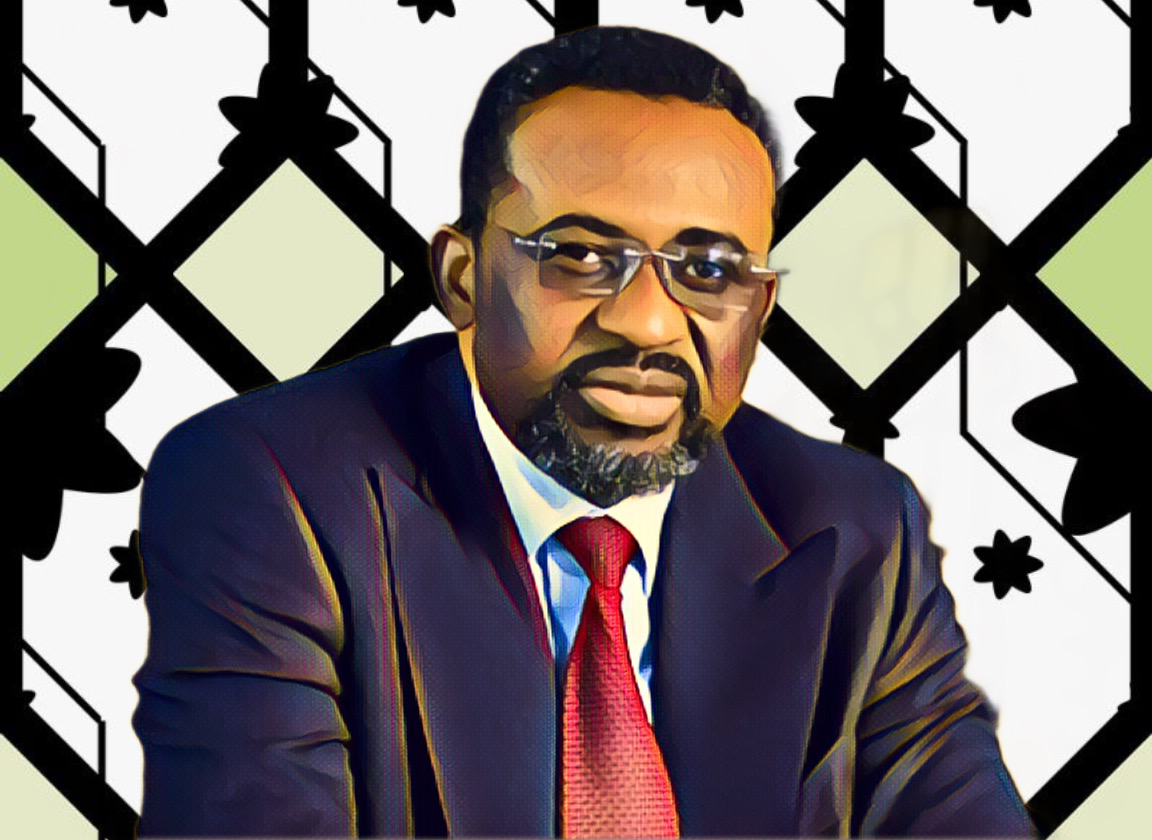

People are carrying more than $1 million out of Ghana without declaring it, Bank of Ghana Governor Dr. Johnson Asiama has revealed, warning that such practices represent significant financial leakages and pose risks to the country’s economy.

Speaking on Joy News’ yet-to-be-aired PM Express Business Edition, Asiama said intelligence reports showed that some individuals move vast amounts of cash across borders, undermining both financial stability and the country’s anti-money laundering campaign.

“If you look at the currency declaration context framework, for example, the intel we got was that some people actually take out large volumes of cash,” he said. “People are carrying over a million dollars just out of Ghana, without declaring these, those are leakages, right?”

Asiama stressed that as a regulator, the central bank must work with agencies such as the Ghana Revenue Authority to ensure accountability. “These are declared. The sources are known. And don’t forget, that’s also good for the anti-money laundering fight that we have on our hands,” he said.

Large cash leakages demand stricter oversight

The governor emphasized that the central bank’s market notices, including those limiting large withdrawals, were not arbitrary but designed to plug systemic gaps. “We are redefining the framework within which the market has to work efficiently,” Asiama explained. “These are things we should have been enforcing, but we’ve seen clearly that we need to set those boundaries clearly so that the markets can function properly.”

He dismissed claims that the Bank of Ghana was overreacting. “No, not at all. We are only taking advantage of what we are seeing to fix the market. It is like a soccer match—there’s a context within which the game has to be played, and that’s exactly what we are doing.”

Bank of Ghana tackles cash withdrawal abuses

According to MyJoyoOnline, the controversial restrictions around corporate withdrawals, Asiama said investigations revealed cases where exporters deposited funds into FCA accounts but then sought to withdraw enormous amounts locally. “Imagine a corporation wanting to withdraw $10 million over the counter. The fact is, what do they use that for? Because their payments are abroad, they don’t carry physical cash to go and settle anything,” he said.

The governor clarified that ordinary individuals would not be affected in the same way. “For individuals like you and me, probably you need your few $100 or $200 to do something, that’s understandable. You can negotiate with your bank,” he explained.

Asiama underscored that these measures were not unilateral. “We met with the banks, with the CEOs of banks a number of times. We took on board the feedback from them. That is why the banks are silent. They are not complaining. It’s because they were consulted. We thought through this together before the notices were issued,” he said.