KEY POINTS

- Minority claims betting tax removal is misleading, as it was never implemented.

- VAT on motor insurance was already exempt, contradicting government claims.

- Introduction of VAT on non-life insurance raises concerns about industry growth.

Ghana’s Minority in Parliament has strongly criticized the government’s 2025 fiscal policy, accusing the Mahama-led administration of misleading citizens over claims of abolishing the betting tax and Value Added Tax (VAT) on motor insurance.

The opposition contends that these taxes were never implemented in the first place, labeling the government’s announcement as deceptive.

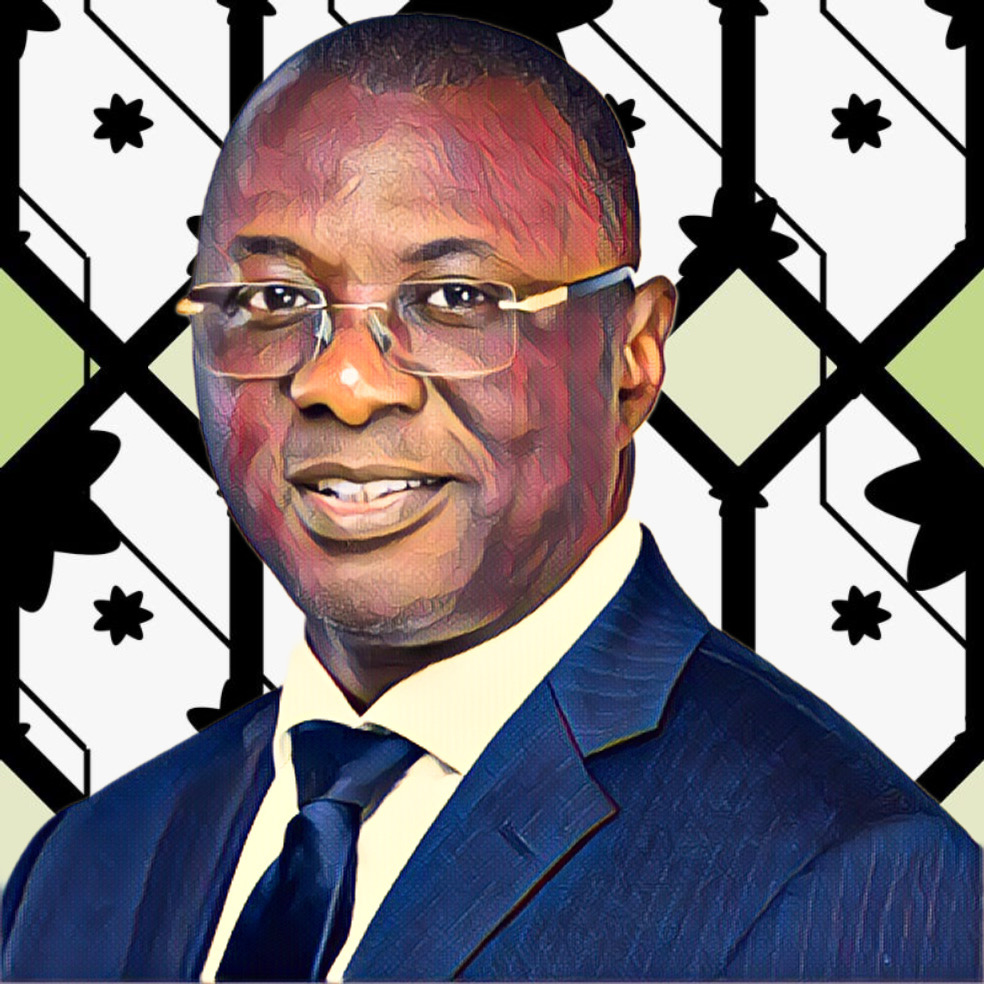

Addressing the media shortly after the presentation of the 2025 Budget Statement and Economic Policy, Dr. Mohammed Amin Adam, Member of Parliament for Karaga and former Finance Minister, expressed frustration at what he described as the government’s attempt to “mislead Ghanaians.”

“Ladies and gentlemen, betting tax that they said they had abolished, we never collected betting tax. We never implemented the betting tax. So, to come and tell Ghanaians that you have abolished something that was never implemented is to deceive the people of Ghana,” Dr. Adam said.

Minority disputes VAT exemption claims

Dr. Adam also challenged the government’s claims about abolishing VAT on motor insurance, arguing that this was another misleading statement.

According to him, VAT on motor insurance had already been exempted. He said the government’s recent pronouncement diverted attention from introducing VAT on non-life insurance.

“The Minister announced that they are abolishing VAT on motor insurance. But we were already not collecting VAT on motor insurance. VAT on motor insurance was exempted,” he emphasized.

He further criticized the government’s decision to introduce VAT on non-life insurance policies, describing it as “smart but deceptive.”

He questioned why authorities would impose such a tax when Ghana’s insurance penetration rate stands at just 1.1 percent. This figure reflects the industry’s struggle to expand coverage.

“This move is shocking, especially when the industry is trying to increase coverage. Instead of creating incentives, the government is introducing measures that will stifle growth,” Dr. Adam argued.

Opposition warns of economic consequences

The Minority’s criticism extends beyond tax claims. Dr. Adam voiced concerns about the broader implications of the government’s fiscal policy on economic growth and investor confidence.

According to Graphic Online, he argued that misleading the public about tax policies could have long-term consequences, especially for industries that are already under pressure.

“We cannot afford to have policies that confuse both the business community and ordinary citizens. The government needs to be transparent and straightforward,” he stated.

Dr. Adam warned Ghanaians to analyze government declarations carefully because the government seemingly released these announcements to create artificial progress illusions.

The government presents the 2025 budget as recovery-focused and citizenship relief-driven but the Minority asserts that the adopted measures are insufficient in the long run.

The discussion about betting taxes and insurance VAT will become more intense in coming weeks as legislators fully review the budget.

For now, the Minority is calling on the government to provide clarity and ensure that policies are implemented transparently and in the best interest of Ghanaians.